Many Southeast Asian digital companies run into obstacles when searching for early-stage progress financing. They won’t need to promote fairness of their firm, however typically wrestle to safe working capital loans from conventional monetary establishments. That’s the place Singapore-based Jenfi is available in, offering revenue-based financing of as much as $500,000 with versatile compensation plans that co-founder and chief government officer Jeffrey Liu refers to as “growth capital as a product.”

While revenue-based financing is gaining traction in lots of different markets, Liu informed TechCrunch that Singapore-based Jenfi is the primary firm of its variety centered on Southeast Asia. The startup introduced right now that it has raised a $6.three million Series A led by Monk’s Hill Ventures. Participants included Korea Investment Partners and Golden Equator Capital, 8VC, ICU Ventures and Taurus Ventures. The firm beforehand raised $25 million in debt financing from San Francisco-based Arc Labs.

Jenfi works primarily with “digital-native” firms, together with SaaS suppliers and e-commerce sellers. Some of its shoppers embrace Tier One Entertainment, Pay With Split and Homebase. Jenfi hasn’t disclosed how a lot non-dilutive financing it’s supplied to date, however its aim is to deploy $15 million by July 2022. It claims that the typical Jenfi buyer skilled compounded gross sales progress of about 26.5% over three months, 60% over six months and 156% over twelve months.

The combination gross sales of firms in its portfolio is at the moment greater than $30 million, and Jenfi expects that the capital it has already deployed will assist them generate $47 million in gross sales, or a 156% improve by July 2021.

Liu launched Jenfi with Justin Louie in 2019, after seeing how conventional monetary establishments have been lagging behind Southeast Asia’s digital increase. The two beforehand based GuavaPass, the health studio membership platform that was acquired by ClassPass in 2019. Jenfi’s creation was motivated by among the challenges Liu and Louie confronted whereas financing a high-growth startup centered on Asian markets.

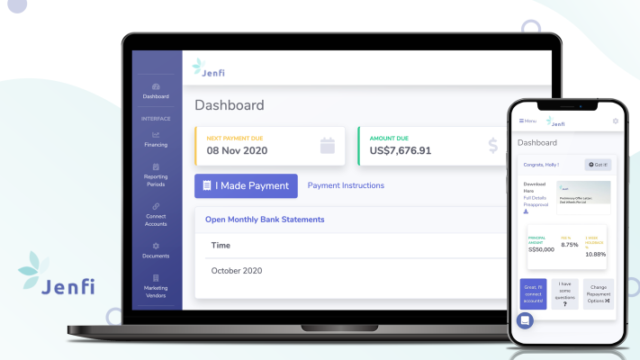

Jenfi’s software course of is totally on-line and in some circumstances, firms have acquired financing in lower than 24 hours, although it sometimes takes just a few days. This is one other profit over conventional working capital loans or personal fairness financing, which may take months to finish, making it troublesome for firms to reply rapidly to income progress alternatives. For instance, an e-commerce firm may have fast working capital to buy extra stock if it all of a sudden will get a number of demand for a sure product.

Some of Jenfi’s Series A may also be used to develop extra integrations for its proprietary threat evaluation engine, which analyzes how effectively firms use their progress spending. Currently, it could faucet into data from financial institution accounts; software program like Xero or Quickbooks; cost gateways together with Stripe and Braintree; e-commerce platforms like Shopify, Shopee and Lazada; and Facebook Ads and Google Ads.

Instead of fastened installment compensation plans, Jenfi offers firms extra versatile goal compensation plans and prices them a flat charge primarily based on the quantity of financing they acquired, their month-to-month gross sales and what number of months it should take to pay again the mortgage. Jenfi continues analyzing the information sources supplied by firms, so it could inform if a consumer doubtlessly wants extra capital or an adjustment to their compensation phrases.

Ultimately, Jenfi’s plan to maneuver past financing and in addition present instruments to assist companies. “We see ourselves as partners in our portfolio companies’ growth,” mentioned Liu.

Since Jenfi faucets into a mixture of information sources—together with financial institution accounts, accounting software program and digital promoting platforms, it could use that very same data to establish alternatives. Part of Jenfi’s Series A funding shall be used to develop automated analytics. For instance, the platform would be capable to establish an promoting…