With regards to the demand aspect, demand has risen considerably for eMMC options with medium- and low-density specs (i.e., 64 GB and decrease), for which NAND Flash suppliers have largely stopped updating the NAND Flash course of expertise, whereas sustaining help with the legacy 2D NAND or the 64L 3D NAND course of. This is on account of sturdy gross sales for Chromebook gadgets and TVs. As older processes steadily account for a reducing portion of bit output proportions from NAND Flash suppliers, these corporations are exhibiting a lowered willingness to straight provide such eMMC merchandise to purchasers. As a outcome, purchasers now want to show to reminiscence module homes, that are capable of supply NAND Flash elements and controllers, to acquire eMMC merchandise in substantial portions.

Hikes in costs of controller ICs will result in hikes in module costs with mainstream 32 GB and 64 GB options for Chromebooks experiencing largest will increase

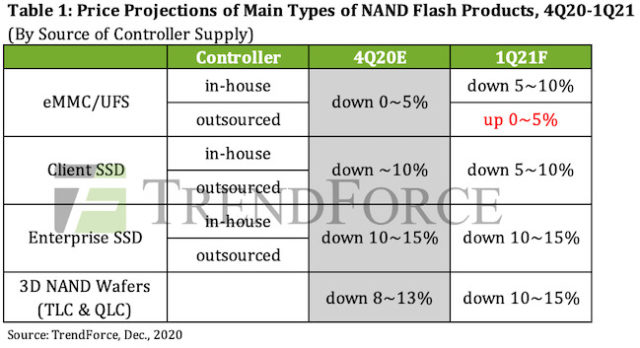

TrendForce factors out that despite the fact that the entire NAND Flash market continues to be in oversupply proper now, medium- and low-density eMMC options will doubtless expertise worth hikes as they’re in tight provide as a consequence of inadequate output of controller ICs. An enhance in costs of controller ICs will end in a corresponding enhance within the mounted prices of eMMC options. This, in flip, will put strain on OEMs which can be procuring elements. With this state of affairs now turning into a actuality, costs of these eMMC options which can be in excessive demand might rise barely in 1Q21. Examples embody 32 GB and 64 GB options for Chromebook gadgets.

In the SSD market, the most important NAND Flash suppliers corresponding to Samsung are additionally the most important gadget producers. Most SSD producers have in-house controller ICs which can be made at foundries underneath long-term agreements. Hence, there have been no reviews of worth hikes or shortages for SSD controller ICs. However, TrendForce has noticed that lead time has been extended for SSD controller ICs as effectively. Additionally, the share of SSD controller ICs which have been outsourced to IC design homes has elevated for SSDs with PCIe 4.0. In the long run, there may be an growing chance that costs of SSD controller ICs will likely be affected by the statuses of outsourced IC suppliers.