Berlin-based finmid — one of many many startups constructing embedded fintech options, in its case focusing on marketplaces that wish to present their very own fee and financing choices — has raised €23 million ($24.7 million) in a Series A spherical to additional construct out its product and enter new markets. The spherical values the corporate at €100 million ($107 million), put up cash.

Marketplaces — sometimes two-sided companies that convey collectively retailers or different third-party suppliers with prospects to purchase their services or products — are very basic targets for embedded finance corporations, not least as a result of they host quite a lot of transaction exercise already, so it is smart for them to construct in additional performance round that to enhance their very own margins.

Players like Airwallex, Rapyd, Kriya, and lots of extra are amongst these constructing for that chance. But finmid believes it has the potential to lock in additional enterprise particularly in its residence area. Small and medium-sized companies in Europe sometimes look to banks to borrow cash. The rise of fintech has opened the door to SMBs accessing extra, diverse sources of financing than ever earlier than, and an rising quantity are doing so.

The startup believes that it makes extra sense for SMBs to entry capital by way of enterprise companions than by way of a financial institution or neobank, and they’ll accomplish that. “In an ideal scenario, you don’t have to get out of that context,” finmid’s co-founder, Max Schertel, instructed TechCrunch in an interview.

It additionally is smart for marketplaces to supply these companies itself: a captive viewers of consumers and the purchasers of their prospects means they’re sitting on a trove of information that may assist produce, for instance, extra customized financing affords.

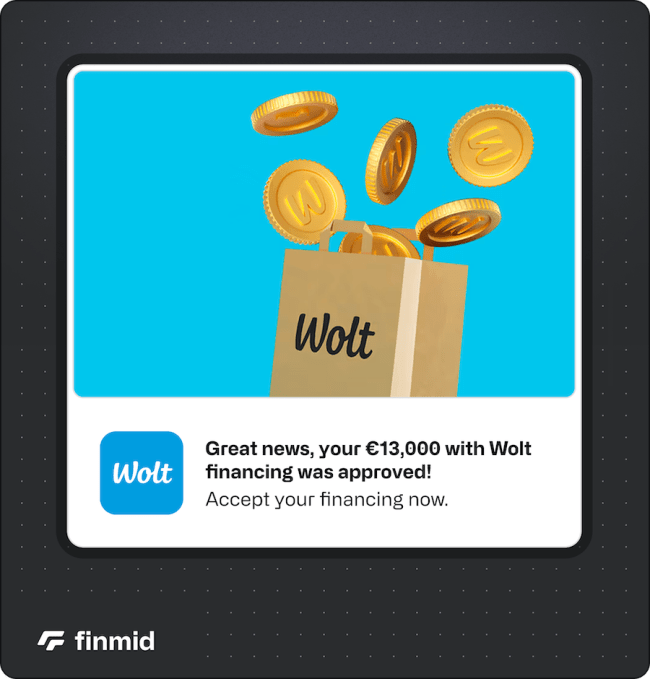

As one instance of how that works, Schertel mentioned that meals supply model Wolt makes use of finmid’s tech to supply money advances to a few of its restaurant companions straight inside its app. Unlike a financial institution, Wolt has entry to the eating places’ gross sales historical past, and finmid helps it leverage that information to determine who will see a pre-approved financing provide.

Image Credits: finmid

The working capital doesn’t come from Wolt, however from finmid’s financing companions. Both finmid and the platform earn a proportion of each transaction. “We have banking relationships with a lot of the large banks,” Schertel mentioned.

For a platform like Wolt, embedding finmid is a method to make life simpler for eating places whereas producing further income with out a lot further effort. That’s a reasonably simple worth proposition, so long as companions are keen to offer the startup’s API a go.

In its early days, finmid’s pitch wasn’t a straightforward promote to VCs, Schertel mentioned. Embedded finance could get quite a lot of hype, however it’s nonetheless an strategy that requires signing on companions to get any outcomes. That takes endurance that not all VCs may have.

However, finmid managed to search out buyers who’ve caught round because it began through the pandemic, and have helped the corporate elevate €35 million in fairness funding to this point. Before this new Series A, the corporate raised €2 million in pre-seed and €10 million in seed funding, finmid’s different co-founder, Alexander Talkanitsa, instructed TechCrunch.

That help appears to be paying off. According to Schertel, as soon as you might be operating on a platform like Wolt, “success really compounds.”

“I like [my] job today a lot better than I did a year ago,” he joked.

Schertel and Talkanitsa met at challenger financial institution N26, whose founder, Max Tayenthal, is now one in all their buyers alongside VC corporations Blossom Capital and Earlybird VC.

The co-founders discovered a vital lesson at N26: monetary infrastructure leaves no house for errors. “You have to invest a lot in reliability,” Schertel mentioned.

Finmid has an API that connects a number of information factors from the platform, and can even plug in different sources of knowledge on the possible borrower, like a financial institution would do.

To make the person expertise extra fluid, finmid can let its…