The United States Department of Commerce Monday proposed investing as a lot as $6.6 billion to fund a 3rd Taiwan Semiconductor Manufacturing Company Limited (TSMC) fab in Arizona. The funding would arrive by means of the CHIPS and Science Act, in a bid to foster extra home semiconductor manufacturing.

The transfer represents a broader push to convey extra manufacturing to the U.S., however unstated within the fanfare round at present’s announcement is the potential escalation of tensions with China.

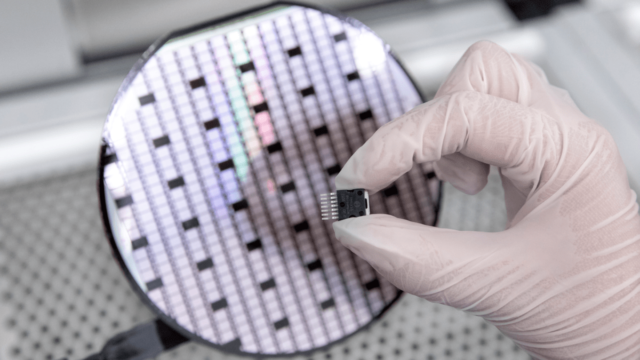

The proposed fab is a greenfield facility — that means it’s custom-built from the bottom up. It would give attention to 2nm (“or newer”) architectures, designed for a slew of various functions, together with computing, 5G/6G wi-fi communications and, in fact, AI. TSMC Arizona — the subsidiary behind the proposed development — has said that it’ll construct the power earlier than the top of the last decade.

The chipmaker says development will convey greater than 20,000 jobs to the realm, whereas forecasting round 6,000 manufacturing roles as soon as the power is operational.

Localized manufacturing has been a key focus for the Biden administration, because the COVID-19 pandemic highlighted vulnerabilities within the international provide chain. Those points have been exacerbated by the ubiquity of silicon in our every day lives. Those numbers are solely rising. According to a semiconductor commerce affiliation, international gross sales hit $47.6 billion in January 2024 — marking greater than a 15% improve over the prior 12 months.

“TSMC’s renewed commitment to the United States, and its investment in Arizona represent a broader story for semiconductor manufacturing that’s made in America and with the strong support of America’s leading technology firms to build the products we rely on every day,” President Biden stated in a launch tied to the information.

Much of the administration’s funding has targeted on U.S. corporations like Intel, which was focused with its personal $8.5 billion proposal towards the top of March. TSMC, nevertheless, is an 800-pound gorilla, each when it comes to market share and technological advances. The agency has, nevertheless, discovered itself in the course of looming geopolitical considerations. The United States and allies could be at an enormous drawback ought to China seize management of Taiwan and its manufacturing capabilities.

TSMC has its personal considerations over such a state of affairs. For one factor, the corporate’s two largest clients — Apple and Nvidia — are American. For one other, some within the U.S. have even gone as far as suggesting the nation bomb chipmakers, ought to such issues come to move.

“We should make it very clear to the Chinese, if you invade Taiwan, we will blow up TSMC,” Massachusetts Congressman Seth Moulton stated at an occasion again in May.

The Democratic consultant has since distanced himself from the clip, stating that it was selectively edited by the Chinese Communist Party. However, he’s hardly alone in floating such solutions. Earlier the identical 12 months, former Trump National Security Advisor Robert O’Brien said, “The United States and its allies are never going to let those factories fall into Chinese hands,” suggesting the nation destroy the factories. O’Brien went as far as evaluating such hypothetical actions to Britain’s actions through the Second World War.

Such saber rattling has drawn worldwide criticism. Beyond the clear moral questions, such an evasive motion would have an enormous affect on the worldwide financial system. In addition to Apple and Nvidia, TSMC additionally serves Sony, MediaTek, AMD, Qualcomm and Broadcom, amongst others.

For all the cash the United States authorities continues to take a position, Intel is just taking part in catch-up to TSMC’s multiyear technological head begin. TSMC makes round 90% of the world’s most superior chips. For now, one of the best protection the U.S. has towards future disruptions — be they pandemics or geopolitical conflicts — is diversification of provide. That applies to the place and by whom elements are manufactured.

While the architects of…