CRED, an Indian fintech startup, has rolled out a brand new function that may assist its clients handle and acquire deeper insights into their money stream, as startup seeks to drive engagement by offering much-needed private finance instruments.

Known primarily for its bank card invoice cost and client lending service, the Bengaluru-based startup is venturing into private finance administration with the brand new function it’s calling CRED Money.

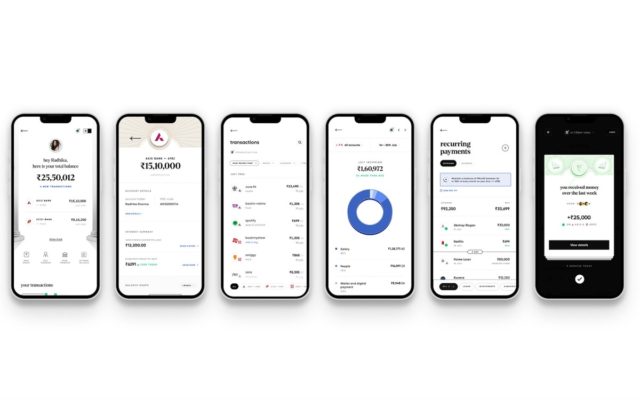

CRED Money consolidates customers’ monetary knowledge from all their financial institution accounts, enabling them to trace their financial institution transactions and recurring funds (together with SIP investments, lease and employees salaries) on one dashboard. Users may also lookup for transactions by retailers or classes and may also get reminders.

The startup stated the function leverages India’s account aggregator framework, a monetary data-sharing system launched by the Reserve Bank of India to boost transparency and consumer management over private monetary data. This framework permits customers to grant short-term, purpose-specific entry to their monetary knowledge throughout a number of establishments by a standardized, encrypted channel.

The startup stated it gained’t be monetizing the brand new function.

CRED, valued at $6.four billion, stated the function employs knowledge science algorithms to research the excessive quantity of transactions carried out by its customers throughout a number of accounts. The platform goals to show this data into temporary actionable insights, probably serving to customers determine spending patterns, funding alternatives, and areas for monetary optimization.

CRED claims that almost 70% of India’s prosperous inhabitants struggles with having their funds fragmented throughout a number of platforms, which is made worse as a result of the typical buyer makes about 200 transactions a month. This administrative overhead can result in suboptimal decision-making and probably affect credit score scores.

“More money, more problems,” stated CRED founder Kunal Shah in a press release. “We have built a product that improves every affluent person’s relationship with money and makes them less anxious about it through a trusted, insightful experience,” he added.

CRED has positioned itself as a platform for wealthy, creditworthy customers since its launch. But like every other demographic, this one can be not proof against monetary mismanagement. Many customers usually neglect to assessment their financial institution statements, disregard essential notifications from banks, and incur penalties for late funds.

CRED Money, launching in phases from Thursday, is the most recent in a collection of additives by the startup. It has been steadily broadening its portfolio, lately buying Kuvera, a platform for mutual fund and inventory investments. CRED’s product growth course of includes intensive inside testing, with new options present process months of worker trials earlier than buyer launch. This strategy ensures that solely options demonstrating clear worth attain the broader consumer base, CRED executives stated.

![[Infographic] Manage Commercial Displays With Ease Across](https://loginby.com/itnews/wp-content/uploads/2026/02/1770220527_Infographic-Manage-Commercial-Displays-With-Ease-Across-238x178.jpg)