Taiwan Semiconductor Manufacturing Co. this week mentioned its income for the second quarter 2024 reached $20.82 billion, making it the corporate’s greatest quarter (at the least in {dollars}) to this point. TSMC’s high-performance computing (HPC) platform income share exceeded 52% for the primary time in a few years as a result of demand for AI processors and rebound of the PC market.

TSMC earned $20.82 billion USD in income for the second quarter of 2024, a 32.8% year-over-year improve and a 10.3% improve from the earlier quarter. Perhaps extra outstanding, $20.82 billion is the next consequence than the corporate posted Q3 2022 ($20.23 billion), the foundry’s greatest quarter to this point. Otherwise, when it comes to profitability, TSMC booked $7.59 billion in internet earnings for the quarter, for a gross margin of 53.2%. This is a good bit off of TSMC’s document margin of 60.4% (Q3’22), and comes as the corporate continues to be within the strategy of additional ramping its N3 (3nm-class) fab strains.

When it involves wafer income share, the corporate’s N3 course of applied sciences (3nm-class) accounted for 15% of wafer income in Q2 (up from 9% within the earlier quarter), N5 manufacturing nodes (4nm and 5nm-classes) commanded 35% of TSMC’s earnings within the second quarter (down from 37% in Q1 2024), and N7 fabrication processes (6nm and 7nm-classes) accounted for 17% of the foundry’s wafer income within the second quarter of 2024 (down from 19% in Q1 2024). Advanced applied sciences all collectively (N3, N5, N7) accounted for 67% of complete wafer income.

“Our business in the second quarter was supported by strong demand for our industry-leading 3nm and 5nm technologies, partially offset by continued smartphone seasonality,” mentioned Wendell Huang, Senior VP and Chief Financial Officer of TSMC. “Moving into third quarter 2024, we expect our business to be supported by strong smartphone and AI-related demand for our leading-edge process technologies.”

TSMC normally begins ramping up manufacturing for Apple’s fall merchandise (e.g. iPhone) within the second quarter of the yr, so it isn’t shocking that income share of N3 elevated in Q2 of this yr. Yet, holding in thoughts that TSMC’s income normally elevated by 10.3% QoQ, the corporate’s shipments of processors made on N5 and N7 nodes are exhibiting resilience as demand for AI and HPC processors is excessive throughout the trade.

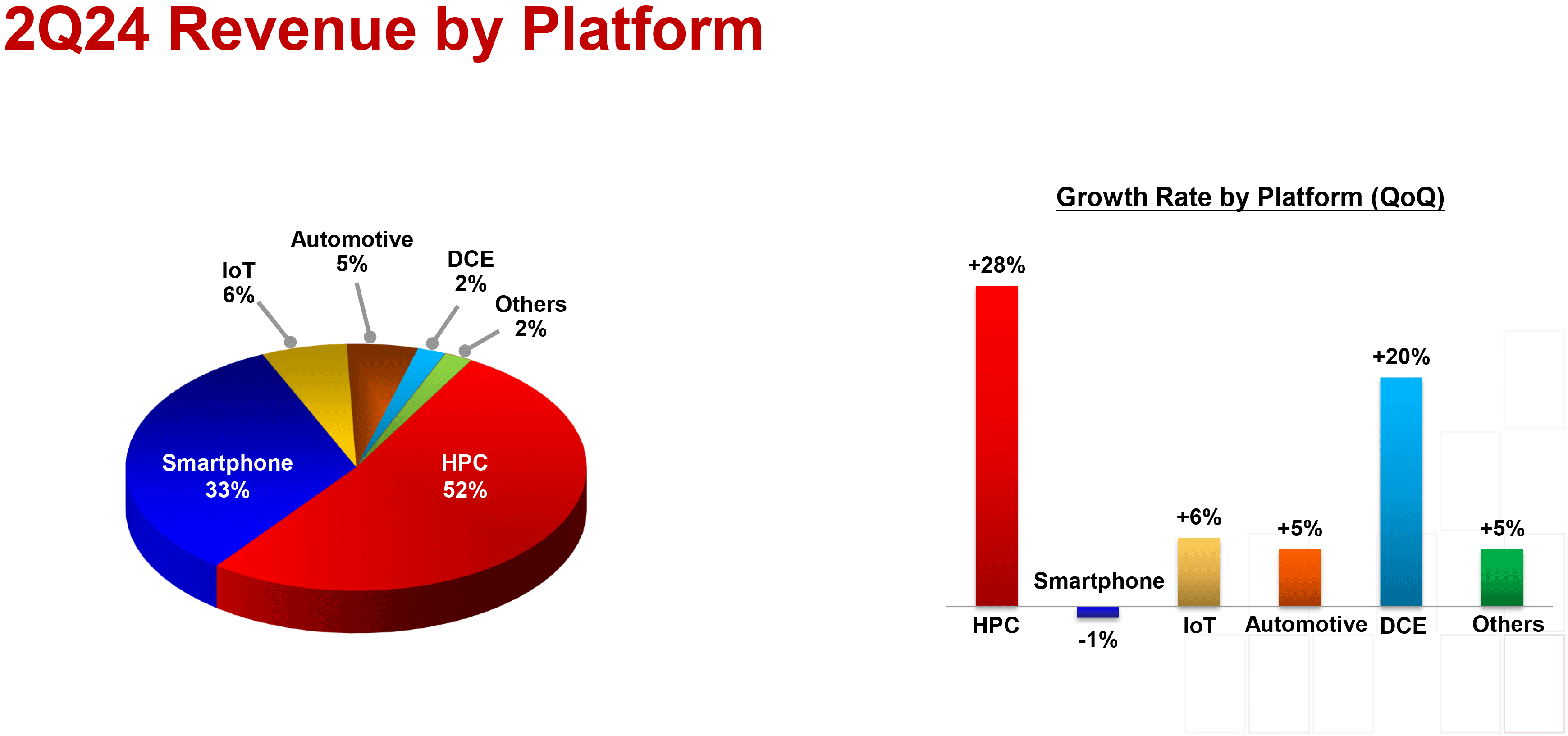

Speaking of TSMC’s HPC gross sales, HPC platform gross sales accounted for 52% of TSMC’s income for the primary time in a few years. The world’s largest contract maker of chips produces many sorts of chips that get positioned underneath the HPC umbrella, together with AI processors, CPUs for shopper PCs, and system-on-chips (SoCs) for consoles, simply to call a couple of. Yet, on this case TSMC attributes demand for AI processors as the principle driver for its HPC success.

As for smartphone platform income, its share dropped to 33% as precise gross sales declined by 1% quarter-over-quarter. All different segments grew by 5% to 20%.

For the third quarter of 2024, TSMC expects income between US$22.Four billion and US$23.2 billion, with a gross revenue margin of 53.5% to 55.5% and an working revenue margin of 42.5% to 44.5%. The firm’s gross sales are projected to be pushed by sturdy demand for modern course of applied sciences in addition to elevated demand for AI and smartphones-related purposes.