Taiwan Semiconductor Manufacturing Co. this week launched its monetary outcomes for Q1 2024. Due to a rebound in demand for semiconductors, the corporate garned $18.87 billion in income for the quarter, which is up 12.9% year-over-year, however a decline of three.8% quarter-over-quarter. The firm says that in improve in demand for HPC processors (which incorporates processors for AI, PCs, and servers) drove its income rebound in Q1, however surprisingly, income share of TSMC’s flagship N3 (3nm-class) course of expertise declined steeply quarter-over-quarter.

“Our business in the first quarter was impacted by smartphone seasonality, partially offset by continued HPC-related demand,” mentioned Wendell Huang, senior VP and chief monetary officer of TSMC. “Moving into second quarter 2024, we expect our business to be supported by strong demand for our industry-leading 3nm and 5nm technologies, partially offset by continued smartphone seasonality.”

In the primary quarter of 2024, N3 wafer gross sales accounted for 9% of the foundry’s income, down from 15% in This autumn 2023, and up from 6% in Q3 2023. In phrases of {dollars}, TSMC’s 3nm manufacturing introduced in round $1.698 billion, which is decrease than $2.943 billion within the earlier quarter. Meanwhile, TSMC’s different superior course of applied sciences elevated their income share: N5 (5 nm-class) accounted for 37% (up from 35%), and N7 (7 nm-class) commanded 19% (up from 17%). Though each remained comparatively flat when it comes to income, at $6.981 billion and $3.585 billion, respectively.

Generally, superior expertise nodes (N7, N5, N3) generated 65% of TSMC’s income (down 2% from This autumn 2023), whereas the broader class of FinFET-based course of applied sciences contributed 74% to the corporate’s complete wafer income (down 1% from the earlier quarter).

TSMC itself attributes the steep decline of N3’s contribution to seasonally decrease demand for smartphones within the first quarter as in comparison with the fourth quarter, which can certainly be the case as demand for iPhones usually slowdowns in Q1. Along these traces, there have additionally been stories a couple of drop in demand for the most recent iPhones in China.

But even when A17 Pro manufacturing volumes are down, Apple stays TSMC’s lead buyer for N3B, because the fab additionally produces their M3, M3 Pro, and M3 Max processors on the identical node. These SoCs are bigger when it comes to die sizes and ensuing prices, so their contribution to TSMC’s income ought to be fairly substantial.

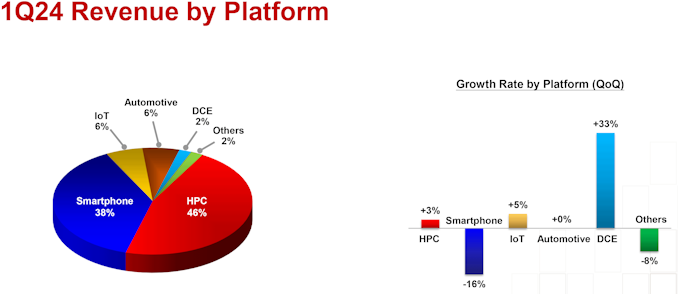

“Moving on to revenue contribution by platform. HPC increased 3% quarter-over-quarter to account for 46% of our first quarter revenue,” mentioned Huang. “Smartphone decreased 16% to account for 38%. IoT increased 5% to account for 6%. Automotive remained flat and accounted for 6%, and DCE increased 33% to account for 2%.”

Meanwhile, as demand for AI and HPC processors will proceed to extend within the coming years, TSMC expects its HPC platform to maintain rising its share in its income going ahead.

“We expect several AI processors to be the strongest driver of our HPC platform growth and the largest contributor in terms of our overall incremental revenue growth in the next several years,” mentioned C.C. Wei, chief govt of TSMC.