South Korean startup True Balance, which operates an eponymous monetary providers app aimed toward tens of tens of millions of customers in small cities and cities in India, has closed a brand new financing spherical because it appears to courtroom extra first time customers on the earth’s second largest web market.

True Balance mentioned on Tuesday that it has raised $23 million in its Series C financing spherical from seven Korean buyers — NH Investment & Securities, IBK Capital, D3 Jubilee Partners, SB Partners, Shinhan Capital, and current companions IMM Investment, and HB Investment.

TechCrunch reported earlier this 12 months that True Balance — which has raised $65 million to this point together with the $38 million that it closed in its earlier financing spherical — was seeking to increase as a lot as $70 million in its Series C spherical.

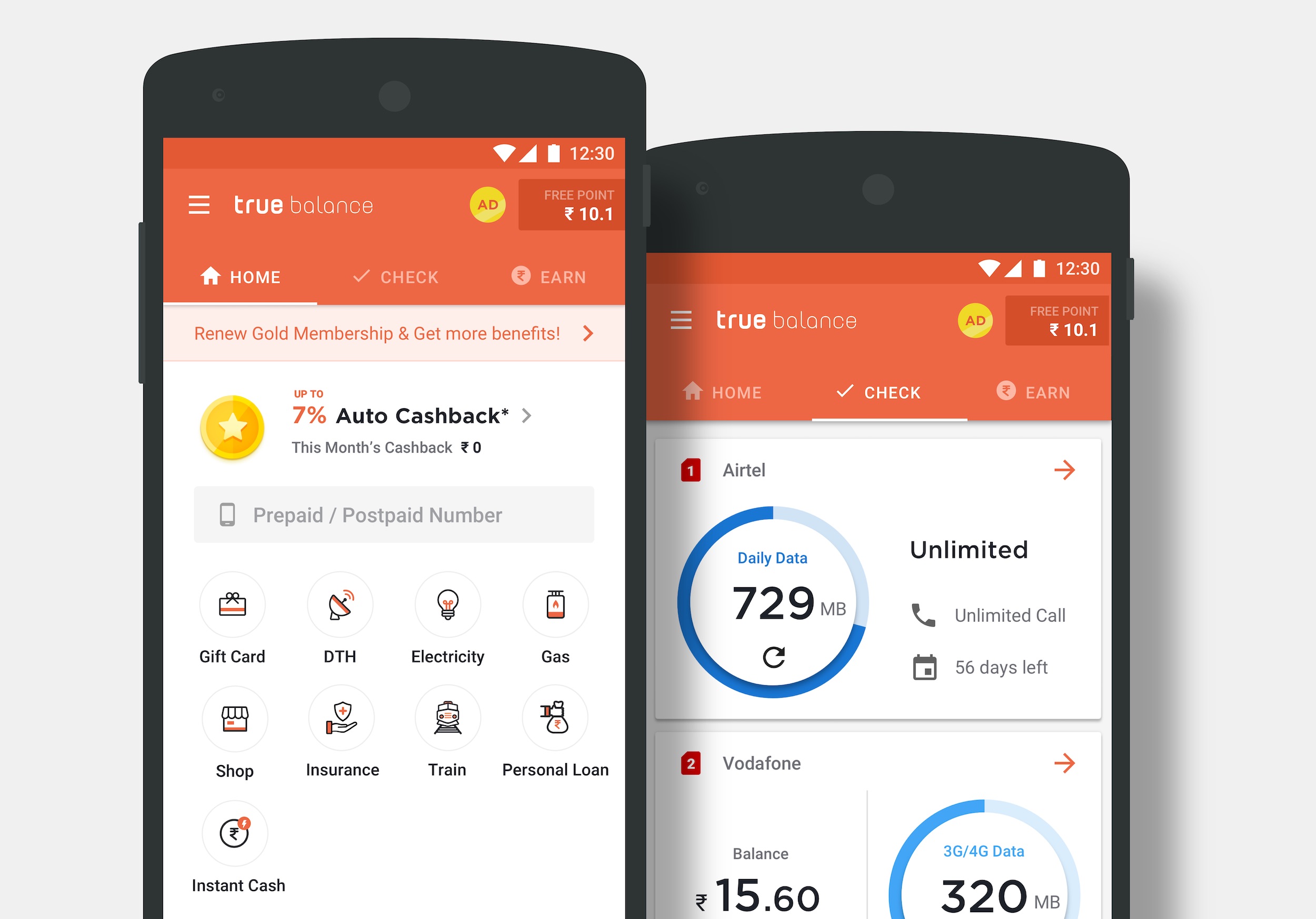

True Balance started its life as a device to assist customers simply discover their cell steadiness, or prime up pre-pay cell credit score. But in its four-year journey, its ambition has considerably grown past that. Today, it serves as a digital pockets app that helps customers pay their cell and electrical energy payments, and provide credit score to prospects in order that they will pay later for his or her digital purchases.

The startup says it has amassed over 60 million registered customers in India, most of whom reside in small cities and cities — or dubbed India 2 and India 3. Most of those customers are coming on-line for the primary time and True Balance says it has a military of native brokers — who get sure incentives — to assist first time web customers perceive the advantage of on-line transactions and begin utilizing the app.

True Balance says it clocks greater than 300,000 digital transactions on its app every day. The startup, which lately launched e-commerce purchasing service on its app to promote merchandise like smartphones, has clocked $100 million in GMV gross sales within the nation to this point.

Charlie Lee, founding father of True Balance, mentioned the startup will use the contemporary capital to bulk up the choices on the app. Some of the options that True Balance intends so as to add earlier than the tip of this fiscal 12 months embrace the flexibility to buy bus and prepare tickets, digital gold, and e-book cooking fuel cylinders.

True Balance can even develop its lending and e-commerce providers, Lee mentioned. Its lending function was used 1 million instances in three months when it was launched earlier this 12 months. “We aim to strengthen our data and alternative credit scoring strategy to provide better financial services to our target — the next billion Indian users. Our goal is to reach 100 million digital touch points and become one of the top fin-tech companies in India by 2022,” he added in a press release.

Even as greater than 600 million customers in India are on-line right now, nearly as many stay offline. In latest years, many main firms in India have began to customise their providers to attraction to customers in India 2 and India 3 — who even have restricted monetary energy.