- Register

- Login

32°C

- Article

- . (0)

- Related content

- Company info

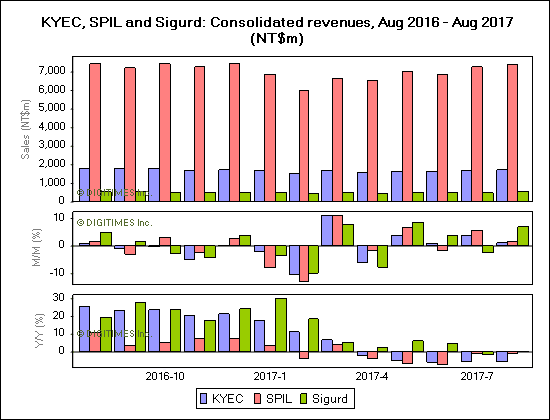

IC backend houses Siliconware Precision Industries (SPIL), Sigurd Microelectronics and King Yuan Electronics Company (KYEC) all saw their August revenues climb to their highest monthly levels so far in 2017.

SPIL announced August consolidated revenues grew 1.6% sequentially to NT$7.38 billion (US$245.1 million). Revenues for the first eight months of 2017 came to NT$54.61 billion, down about 2% on year.

SPIL is expected to see its third-quarter revenues reach NT$21.8-22 billion, which will hit the second highest quarterly levels in the company’s history, driven by a pull-in of orders from the non-Apple camp, as well as orders for consumer electronics devices, according to market watchers.

Testing specialist KYEC reported August consolidated revenues increased 1.1% on month to NT$1.72 billion. The company saw its cumulative 2017 revenues through August grow by a slight 0.7% on year to NT$13.04 billion.

Market watchers expect KYEC’s revenues to rise 7-9% sequentially to about NT$5.2 billion in the third quarter, with gross margin remaining above 30%. Revenues will peak for 2017 in the fourth quarter, the watchers said.

Sigurd posted consolidated revenues for August 2017 grew about 7% on month and 0.2% on year to NT$536 million. The company’s cumulative 2017 revenues through August increased 7.3% from a year earlier to NT$3.96 billion.

Smartphone companies’ roll-outs of their flagship models have stimulated demand for handset SoCs, power management chips and communications ICs, enabling Sigurd to enjoy the highest monthly revenues thus far in 2017, according to the testing house.

Market watchers expect Sigurd to generate revenues of between NT$1.56 billion and NT$1.58 billion in the third quarter, and likely see the revenues reach an all-time high.

|

KYEC, SPIL and Sigurd: Consolidated revenues, Aug 2016 – Aug 2017 (NT$m) |

|||||||

|

Month |

SPIL |

KYEC |

Sigurd |

||||

|

Sales |

Y/Y |

Sales |

Y/Y |

Sales |

Y/Y |

||

|

Aug-17 |

7,376 |

(0.8%) |

1,723 |

(5.5%) |

536 |

0.2% |

|

|

Jul-17 |

7,261 |

(0.8%) |

1,704 |

(5.5%) |

501 |

(1.7%) |

|

|

Jun-17 |

6,878 |

(7%) |

1,642 |

(5.8%) |

513 |

4.8% |

|

|

May-17 |

6,993 |

(6.3%) |

1,628 |

(5%) |

495 |

6.2% |

|

|

Apr-17 |

6,554 |

(4%) |

1,572 |

(1.8%) |

456 |

2.3% |

|

|

Mar-17 |

6,668 |

3.9% |

1,675 |

6.7% |

493 |

5.5% |

|

|

Feb-17 |

6,002 |

(3.9%) |

1,510 |

11.2% |

458 |

18.6% |

|

|

Jan-17 |

6,881 |

3.7% |

1,683 |

17.7% |

508 |

30.3% |

|

|

Dec-16 |

7,469 |

7.7% |

1,718 |

21.4% |

527 |

24.3% |

|

|

Nov-16 |

7,271 |

7.4% |

1,714 |

20.7% |

507 |

17.7% |

|

|

Oct-16 |

7,438 |

5.3% |

1,802 |

23.7% |

529 |

24% |

|

|

Sep-16 |

7,207 |

3.5% |

1,805 |

23.4% |

544 |

27.7% |

|

|

Aug-16 |

7,433 |

10.7% |

1,822 |

25.5% |

536 |

19.6% |

|

*Figures are consolidated

Source: TSE, compiled by Digitimes, September 2017

-

Chipbond 3Q17 revenues to hit record high

Bits + chips | 5h 26min ago

-

Synnex August revenues hit record

IT + CE | 7h 34min ago

-

Egistec posts record August revenues

Bits + chips | 7h 38min ago

-

Touch Taiwan 2017 to kick off September 20

Displays | 7h 42min ago

-

Quanta Storage aims to ship 1,000 collaborative industrial robots in 2017

Before Going to Press | 6h 9min ago

-

Xiami to launch Mi A1 smartphone in developing markets

Before Going to Press | 6h 12min ago

-

Inductor makers to post record high revenues in 3Q17

Before Going to Press | 6h 12min ago

-

HannStar August revenues increase

Before Going to Press | 6h 13min ago

-

Acquiring Lexar will not create brand-OEM conflict, says Longsys

Before Going to Press | 6h 13min ago

-

Asix, Pixart to post double-digit revenue growths in 3Q17

Before Going to Press | 6h 14min ago

-

China market: Marvell SSD controller shipments jump

Before Going to Press | 6h 14min ago

-

Simplo developing robotic arms

Before Going to Press | 7h 30min ago

-

Chicony Power sees increased August revenues

Before Going to Press | 7h 33min ago

-

Darfon August revenues down on year

Before Going to Press | 7h 55min ago

-

Seiko Epson aims at over 50% share in Taiwan industrial robots market

Before Going to Press | 7h 57min ago

- China AMOLED panel capacity expansion forecast, 2016-2020

This Digitimes Research Special Report examines the China AMOLED industry, focusing on the expansion capacity of the makers, the current implementation plans of major smartphone vendors in the market and the technological hurdles faced by the China makers.

- Global AP demand forecast, 2017-2020

Digitimes Research expects global AP shipments to surpass the 1.9 billion mark in 2017, with smartphones remaining the main application. Qualcomm will be leading the market in 2017, as other players continue playing catch up and scramble for funds to invest in more diverse applications.

- Global notebook shipment forecast, 2017 and beyond

This Digitimes Special Report examines key factors in the notebook industry, including products, vendors and ODMs, that will affect total shipments in 2017 and through 2021.