In order to answer altering market circumstances, SK hynix proactively adjusted each funding and output stage final yr to maximise enterprise administration effectivity. However, amid rising world financial uncertainty, the rise of stock burden and conservative buying insurance policies on the facet of the purchasers led to a slowdown in demand in addition to value falls. As a outcome, the Company’s earnings decreased year-over-year (YoY).

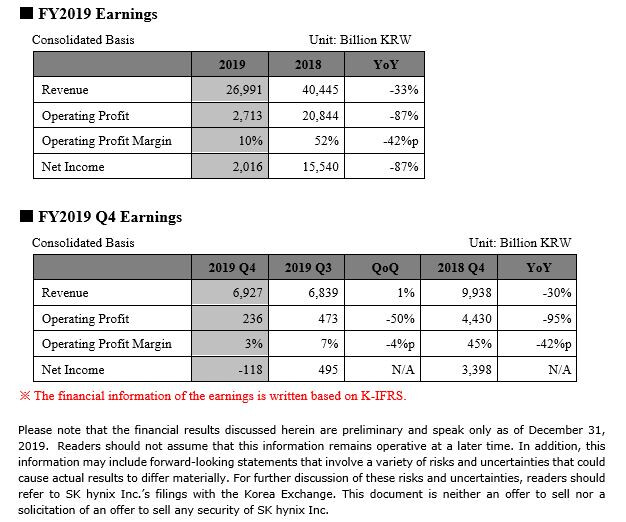

The consolidated fourth quarter income was 6.93 trillion gained, whereas the working revenue amounted to 236 billion gained with working margin of three%, and the online loss 118 billion gained. Despite bearish US greenback, SK hynix’s fourth quarter income elevated by 1% quarter-over-quarter (QoQ) because the Company actively responded to demand restoration. However, the fourth quarter working revenue decreased by 50% QoQ, because of the comparatively low profitability of the product traces, the proportion of which had expanded to fulfill demand enhance, and the price burden of latest expertise migration.

DRAM bit shipments elevated by 8% QoQ, and the common promoting value dropped by 7%. NAND Flash bit shipments elevated by 10% QoQ, and the common promoting value remained steady.

While SK hynix sees the latest enchancment in demand flows positively, the Company will perform extra prudent manufacturing and funding methods, as complexities and uncertainties nonetheless stay a lot greater than previously. As such, the Company goals to enhance expertise maturity quickly within the technique of expertise migration and put together for next-generation merchandise, accelerating price discount.

For DRAM, SK hynix plans to extend the proportion of 1Y nm merchandise and give attention to markets that are anticipated to develop, reminiscent of LPDDR5. Additionally, the Company will start mass-production of 1Znm merchandise inside 2020.

For NAND Flash, SK hynix will constantly enhance the proportions of 96-layer merchandise and SSD gross sales. The Company may also begin mass-production of 128-layer merchandise this yr and purpose to extend the gross sales within the high-density resolution market.

SK hynix introduced the brand new dividend coverage with the intention to enhance the predictability of the stakeholder return and mirror earnings fluctuations. The Company will repair the minimal dividend per share at 1,000 gained, and pay out 5% of the annual free money circulation. According to the brand new coverage, SK hynix’s dividends per share in 2019 is decided 1,000 gained, contemplating that the Company’s free money circulation was under zero in fiscal yr 2019.

![[Video] Everyday Freedom, Hands-Free With the Galaxy Buds4](https://loginby.com/itnews/wp-content/uploads/2026/03/Video-Everyday-Freedom-Hands-Free-With-the-Galaxy-Buds4-100x75.jpg)