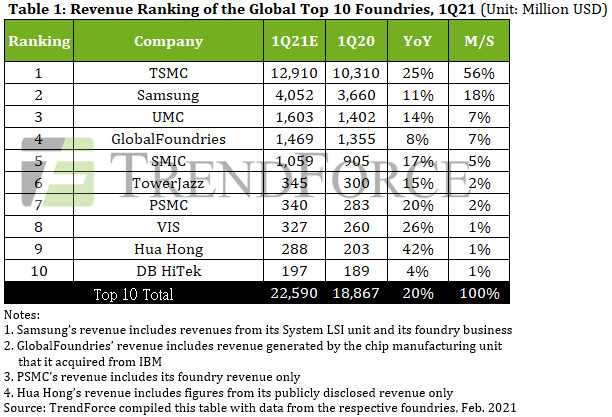

TSMC has been sustaining a gentle quantity of wafer inputs at its 5 nm node, and these wafer inputs are projected to account for 20% of the corporate’s income. On the opposite hand, owing to chip orders from AMD, Nvidia, Qualcomm, and MediaTek, demand for TSMC’s 7 nm node is likewise sturdy and prone to account for 30% of TSMC’s income, a slight improve from the earlier quarter. On the entire, TSMC’s income is predicted to endure a 25% improve YoY in 1Q21 and set a brand new excessive on the again of surging demand for 5G, HPC, and automotive functions.

In response to elevated shopper demand for 5G chips, CIS, driver ICs, and HPC chips, Samsung will proceed to lift its semiconductor CAPEX this 12 months, which is split between its reminiscence and foundry companies and represents Samsung’s want to catch as much as TSMC. With regards to course of applied sciences, the Korean firm’s capability utilization charges for the 5 nm and seven nm nodes have been comparatively excessive in 1Q21, throughout which Samsung is predicted to extend its income by 11% YoY.

In addition to chip demand from the automotive sector, UMC has been maintaining with manufacturing driver ICs, PMICs, RF front-end, and IoT merchandise. The firm’s capability thus stays absolutely loaded in 1Q21, and UMC is predicted to endure a 14% YoY improve in income. WorldFoundries is equally experiencing excessive capability utilization charges as a result of improve in automotive chip demand, in addition to the army chips that it has been manufacturing for the U.S. Department of Defense. WorldFoundries’ income is predicted to extend by 8% YoY in 1Q21.

SMIC’s income for the 14 nm and beneath nodes is predicted to say no in 1Q21 as the corporate was added to the Entity List by the U.S. and subsequently confronted constraints within the improvement of superior processes. However, with the persistent demand within the foundry marketplace for mature processes above (together with) the 40 nm node, SMIC’s income is projected to remain on a optimistic trajectory and attain a 17% YoY improve in 1Q21. TowerJazz will spend about US$150 million on a small-scale capability enlargement, however tools move-in and calibrations is not going to be finalized till roughly 2H21, after which the expanded capability will begin measurably contributing to the corporate’s income. In 1Q21, TowerJazz’s income is predicted to be on par with the earlier quarter whereas reaching a 15% improve YoY.

PSMC is primarily centered on manufacturing reminiscence merchandise, DDICs, CIS, and PMICs. At the second, excessive demand for 8-inch and 12-inch wafer capacities and for automotive chips has resulted in absolutely loaded capability for PSMC. The firm’s income is predicted to extend by 20% YoY in 1Q21. Likewise, VIS’ capability is absolutely loaded throughout all of its course of applied sciences. Driven by elevated spec necessities for PMICs and small-sized DDICs, VIS’ income is predicted to extend by 26% YoY in 1Q21. Finally, Hua Hong is at present inserting appreciable emphasis on increasing the 12-inch capability of HH Fab7 in Wuxi. Process applied sciences for 12-inch manufacturing strains, together with NOR, BCD, Super Junction, and IGBT, have all handed {qualifications},…

![[Video] Everyday Freedom, Hands-Free With the Galaxy Buds4](https://loginby.com/itnews/wp-content/uploads/2026/03/Video-Everyday-Freedom-Hands-Free-With-the-Galaxy-Buds4-100x75.jpg)