Nubank is taking its first tentative steps into the cell community realm, because the NYSE-traded Brazilian neobank rolls out an eSIM (embedded SIM) service for vacationers. The service will give prospects entry to 10GB of free roaming web in additional than 40 international locations with out having to modify out their very own current bodily SIM card or eSIM.

The launch comes shortly after information first emerged that Brazil’s National Telecommunications Agency (ANATEL) had quietly greenlit plans for Nubank to develop into a cell digital community operator (MVNO) in partnership with wi-fi big Claro. While that plan stays within the early levels and Nubank hasn’t confirmed any of the launch particulars (the corporate additionally declined to remark for this text), we are able to now verify that it’s not less than tiptoeing into the cell community sphere — a rising development inside the fintech fraternity.

From neobanks to neo-MVNOs

Neobanks — a brand new breed of economic establishment that function digital-native challengers to established banking incumbents — comply with within the footsteps of conventional banks by providing ancillary providers to focus on new prospects, similar to budgeting instruments, knowledge and spending insights, and easy accessibility to the inventory market. While neobanks have surged in reputation, so has the MVNO (cell digital community operator) market, pushed by the rise of eSIM, the cloud, and the proliferation of third-party software program that makes all-digital distribution methods a cinch.

Nubank sits on the intersection of those traits.

The 10-year-old Brazilian firm has been on a tear of late, its valuation surging by round 170% previously yr and hitting an all-time excessive of $58 billion in March. The firm swung from a $9 million internet loss in 2022 to a $1 billion internet revenue final yr, a development that’s persevering with into 2024 with file revenues in Q1 and its internet revenue greater than doubling on the earlier yr’s corresponding interval. Nubank additionally handed 100 million prospects throughout its core markets of Brazil, Mexico, and Colombia, the place it operates a spread of providers together with financial institution accounts, bank cards, loans, insurance coverage, investments, and — now — a cell knowledge service for travellers.

The new service is aimed toward prospects of Nubank Ultravioleta, a premium subscription it launched three years in the past with bundled advantages similar to insurance coverage, increased credit score limits, cashback, household accounts, and extra.

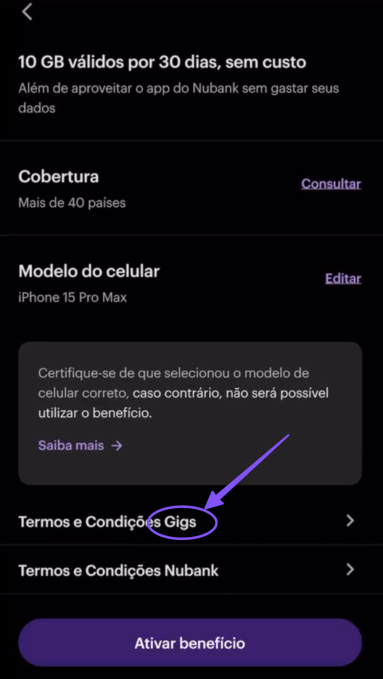

Last month, Nubank revealed it was getting into the journey sector with the approaching launch of a brand new “global account,” partnering with European fintech Wise to supply Ultravioleta subscribers low-fee worldwide cash transfers. As a part of this, the corporate is now launching an eSIM service for these with suitable smartphones, with 10GB of knowledge for vacationers within the U.S., Latin America, and Europe. The eSIM is activated by means of the Nubank app, with the underlying infrastructure powered by Gigs, a platform that offers budding cell community suppliers every part they want by means of a single API — mainly what Stripe has been doing in finance, however for cell phone plans.

Gigs is backed by the likes of Google’s early-stage enterprise capital arm Gradient Ventures and Uber CEO Dara Khosrowshahi.

“Bundling mobile plans represents a powerful lever for neobanks to turn irregular users into monthly paying subscribers, encourage upgrades to premium features, and create an ecosystem where banking acts as a hub for multiple value-added services,” Gigs co-founder and CEO Hermann Frank instructed TechCrunch.

Nubank’s launch echoes strikes elsewhere within the fintech fray. In February, Revolut — a $25 billion U.Ok. neobank — launched the same eSIM service for premium subscribers. And final yr, Indian neobank Zolve additionally