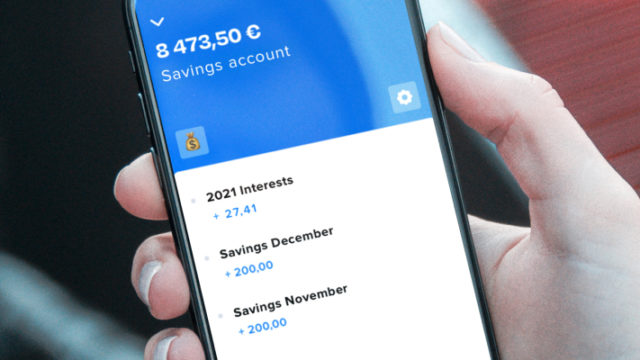

French startup Lydia is best referred to as the dominant app for peer-to-peer funds. But the corporate has been including extra options, similar to a debit card, account aggregation, donations, cash pots and extra. This week, the corporate is including financial savings accounts due to a partnership with French fintech startup Cashbee.

If you aren’t accustomed to Cashbee, the corporate allows you to open financial savings accounts by way of a cellular app. After connecting your checking account with Cashbee, you’ll be able to switch cash forwards and backwards between your checking account and a financial savings account.

Right now, Cashbee companions with My Money Bank for the financial savings accounts. Cashbee doesn’t maintain your cash, it simply acts as a center individual between your checking account and My Money Bank. With these financial savings accounts, customers can count on an rate of interest of 0.6% after an introductory price of two% for a number of months.

Lydia mainly provides the identical phrases and situations with a number of variations. Instead of incomes 2% curiosity for the primary three months, Lydia customers solely earn extra pursuits throughout the first two months.

The different large distinction is that Lydia asks you to place at the least €1,000 in your financial savings account while you open it. If you undergo Cashbee’s app, you solely should put €10 or extra. But customers can do no matter they need after that relating to placing some cash apart and withdrawing cash from the financial savings account.

But the truth that Cashbee is seamlessly built-in in Lydia is attention-grabbing. It’s going to reveal Cashbee to much more customers as Lydia has greater than 5 million customers. It’s additionally an essential options if Lydia desires to grow to be a monetary tremendous app.

This financial savings function competes with Livret A, probably the most prevailing financial savings account in France. Everybody can open a Livret A in a retail financial institution. You get an rate of interest of 0.5% internet of taxes. On paper, 0.6% is best than 0.5%. But Cashbee’s financial savings accounts aren’t internet of taxes.

If you’re a scholar and don’t pay any taxes, that’s a greater deal. But many individuals pay 30% in taxes on accrued pursuits, which implies that you find yourself incomes 0.42% in pursuits internet of taxes with a Cashbee account.

But it’s arduous to beat the simplicity of Lydia’s resolution right here. For occasion, it can save you as much as €1,000,000 in your financial savings account whereas the Livret A is proscribed to €22,950. In different phrases, if you happen to’re already utilizing Lydia to ship, obtain and spend cash, you would possibly need to try these financial savings accounts.