Investors are betting on Indian wealthtech startups as a rising center class turns to diversify investments and startups problem conventional monetary advisors for high-net-worth purchasers.

Premji Invest is in superior phases of talks to guide a funding spherical of $30 million to $40 million in Dezerv, an app providing a collection of funding options to India’s rich, three sources aware of the matter instructed TechCrunch. The present talks worth Dezerv at about $170 million pre-money, greater than doubling its valuation since its final funding spherical.

Lightspeed Venture is in superior talks to guide an funding spherical bigger than $20 million in Centricity, a digital wealth administration platform, two sources mentioned. In October, Peak XV agreed to speculate about $35 million in wealth and asset administration startup Neo.

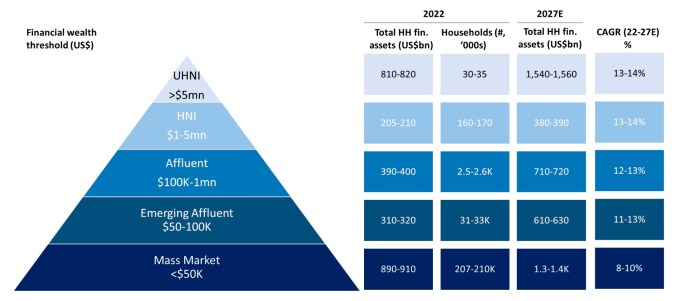

The high-net-worth and ultra-high-net-worth segments are booming in India, prompting some wealth administration corporations to aggressively broaden their relationship supervisor networks to seize this market. Only about 50-55% of India’s wealth administration market is at present underneath skilled administration, in keeping with analysts.

A good portion of those providers stay relationship-driven and demand a bespoke method. Investors are betting that startups can reduce the middlemen, supply extra personalised and data-driven suggestions to prospects and likewise serve a category of the market at present uncared for by incumbents.

Accel-backed Scripbox has had a turnaround in its enterprise within the final two years, an business analyst quipped. It has turned worthwhile, is “well capitalized,” and manages belongings of over $2 billion, Scripbox founder and chief govt Atul Shinghal instructed TechCrunch.

The broader India guess

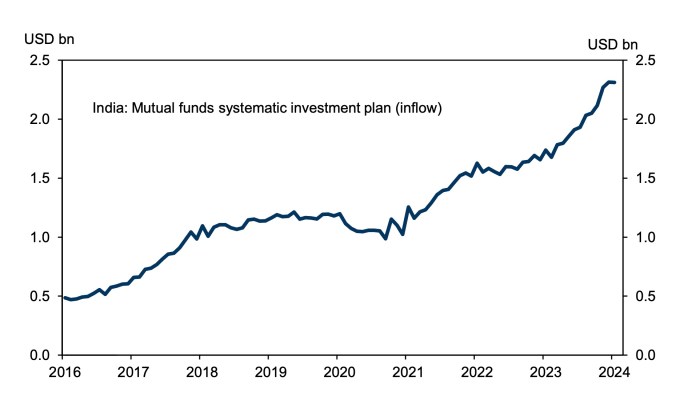

India can be experiencing a surge within the financialization of its financial system, with important development witnessed in sectors like insurance coverage, and mutual funds. The variety of mutual fund accounts is up 3.5x since 2015, with exponential features in low ticket dimension systematic accounts over the previous three years, in keeping with Macquarie.

And there’s nonetheless a whole lot of room for development: India’s ratio of mutual fund AUM-to-GDP is at 15% versus a worldwide common of 75%, in keeping with Macquarie. “As penetration improves, we believe the mutual fund industry can quite comfortably continue to grow at 20% for the foreseeable future,” they wrote in a observe. This optimism is echoed in long-term development projections from main monetary establishments. UBS estimates a 22-25% CAGR in energetic AUM over FY24-27E for main gamers within the wealth administration area.

A variety of startups are additionally making inroads serving to extra Indians spend money on mutual funds, shares, and gold. Jar, backed by Tiger Global, permits prospects to construct a behavior of financial savings. The startup, focusing on a $100 billion Indian gold market, is already seeing its common buyer make 22 investments every month, Nishchay AG, its co-founder, instructed TechCrunch.

India’s prosperous inhabitants is poised for explosive development. The variety of people with annual incomes exceeding $10,000 is anticipated to greater than double within the subsequent 5 years, in keeping with UBS, offering a robust tailwind for monetary providers platforms focusing on this demographic. Industry has taken observe.

360 One WAM, India’s largest wealth supervisor targeted on ultra-high-net-worth people, agreed to amass common Indian mutual fund funding app ET Money for about $44 million final month.

CRED agreed to amass mutual fund funding platform Kuvera earlier this 12 months. Smallcase, a startup that CRED evaluated for an acquisition earlier however handed, is in talks to boost $40 million at a few valuation of $240 million, in keeping with three folks acquainted…

![[Video] Reimagined for Orchestra, ‘Over the Horizon 2026’](https://loginby.com/itnews/wp-content/uploads/2026/02/Video-Reimagined-for-Orchestra-‘Over-the-Horizon-2026’-100x75.jpg)