Once once more kicking off our earnings season protection for the tech business is Intel, who reported their Q3 2020 monetary outcomes this afternoon. The conventional chief of the pack in multiple manner, Intel has been below extra intense scrutiny as of late, notably as a consequence of their beforehand disclosed delay of their 7nm manufacturing schedule. None the much less, Intel has been posting report revenues and earnings in latest quarters – even with a world pandemic happening – which has been retaining Intel in good condition. It’s solely now, with Q3 behind them, that Intel is beginning to really feel the pinch of market shifts and technical debt – and even then the corporate remains to be effectively into the black.

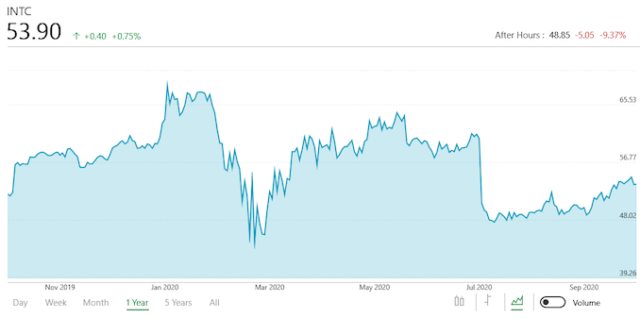

For the third quarter of 2020, Intel reported $18.3B in income. A drop of $0.9B over the year-ago quarter. As beforehand talked about, Intel has been setting a string of report revenues in earlier quarters, however the growth is coming to an finish as margins and revenues are slipping. Those declines are additionally having the anticipated knock-on impact to Intel’s profitability, with the corporate reporting $4.3B in web revenue, a 29% drop versus Q3’19.

This additionally marks the second quarter the place Intel’s total gross margin has been noticeably smooth. The firm, usually recognized for its zeal for 60% margins, recorded a margin of simply 53.1% for Q3, following final quarter’s 53.3%, and 58.9% a yr in the past. The drop in gross margins is a giant a part of Intel’s monetary story for the newest quarter: in response to the corporate, common promoting costs (ASPs) are down as prospects gravitate in the direction of cheaper merchandise, and in the meantime prices are up as Intel additional ramps up its 10nm plans.

| Intel Q3 2020 Financial Results (GAAP) | |||||

| Q3’2020 | Q2’2020 | Q3’2019 | |||

| Revenue | $18.3B | $19.7B | $19.2B | ||

| Operating Income | $5.1B | $5.7B | $6.4B | ||

| Net Income | $4.3B | $5.1B | $6.0B | ||

| Gross Margin | 53.1% | 53.3% | 58.9% | ||

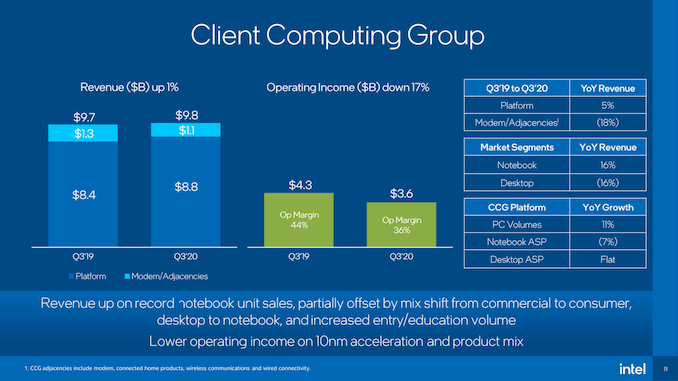

| Client Computing Group Revenue | $9.8B | +4% | +1% | ||

| Data Center Group Revenue | $5.9B | -17% | -8% | ||

| Internet of Things Group Revenue | $677M | +1% | -33% | ||

| Mobileye Revenue | $234M | +60% | +2% | ||

| Non-Volatile Memory Solutions Group | $1.2B | -31% | -11% | ||

| Programmable Solutions Group | $411M | -18% | -19% | ||

Breaking issues down on a gaggle foundation, the vast majority of Intel’s inner reporting teams have seen income declines over the year-ago quarter. Though nonetheless not Intel’s largest section, their information heart group has been the corporate’s largest star over the previous yr and a major income. But revenues have begun slipping there, and for Q3’20 Intel booked $5.9B, which is down 8% from final yr. Driving this decline has been a drop in ASPs, which dropped 15% versus the year-ago quarter. Breaking this down, Intel cites a major drop in enterprise and authorities gross sales, coupled with a leap in 5G SoC gross sales which are dragging down the typical.

As for Intel’s consumer computing group, revenues have held simply barely higher than regular, rising 1% over final yr. Still Intel’s largest group by income, consumer computing has been essentially the most uncovered to adjustments in shopping for habits from the coronavirus shift, which is represented in Intel’s income combine. Desktop gross sales are down and pocket book gross sales are up; sadly pocket book ASPs are down, handicapping the income positive factors there. Overall Intel is reporting that prospects have shifted to cheaper processors, which has pushed the income declines.

Meanwhile the largest loser for Intel in Q3 has been their IoT group, which noticed a 33% drop in income as Intel was impacted by each the pandemic and new US authorities export restrictions. Its counterpart Mobileye fared higher, nonetheless, with income rising…