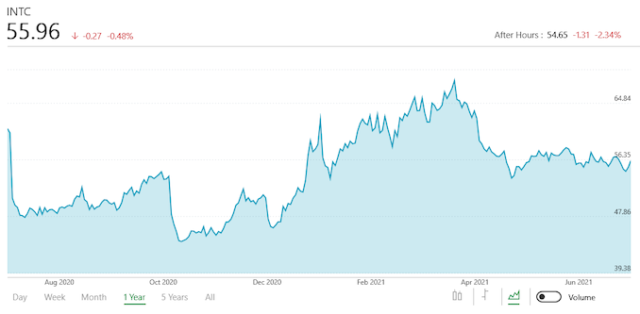

Kicking off one other earnings season for the tech business, we as all the time begin issues off with Intel, who’s the primary massive chipmaker out of the gate. Over a 12 months into the coronavirus pandemic – and slowly heading out of it – Intel has seen its ups and downs as product calls for have shifted and the corporate’s capacity to execute over the long run has been challenged by fab delays. Following a very painful (by Intel requirements) first quarter, the corporate is hoping to place these issues behind them with a stronger second quarter.

For the second quarter of 2021, Intel reported $19.6B in income, a decline of lower than $100M versus Q2’20, and what Intel is looking a flat distinction general. More importantly, maybe, is that Intel’s profitability has additionally held fairly regular (and considerably improved over Q1), with Intel reserving $5.1B in internet earnings for the quarter, a YoY decline of 1%. Overall, with a lone caveat, Intel’s Q2 efficiency has exceeded their earlier projections.

Intel’s famed gross margin has additionally recovered on each a quarterly and yearly foundation. At 57.1% it’s up virtually 2 proportion factors increased than Q1, and virtually four proportion factors increased than Q2’20. Intel’s gross margin has been topic to higher than standard fluctuations as of late – sometimes dropping at any time when a significant new product is ramping – however no less than for Q2 it’s on the rise as Intel enjoys a really worthwhile quarter.

| Intel Q2 2021 Financial Results (GAAP) | |||||

| Q2’2021 | Q1’2021 | Q2’2020 | |||

| Revenue | $19.6B | $19.7B | $19.7B | ||

| Operating Income | $5.5B | $3.7B | $5.7B | ||

| Net Income | $5.1B | $3.4B | $5.1B | ||

| Gross Margin | 57.1% | 55.2% | 53.3% | ||

| Client Computing Group Revenue | $10.1B | -5% | +6% | ||

| Data Center Group Revenue | $6.5B | +16% | -9% | ||

| Internet of Things Group Revenue | $984M | +8% | +47% | ||

| Mobileye Revenue | $327M | -13% | +124% | ||

| Non-Volatile Memory Solutions Group | $1.1B | flat | -34% | ||

| Programmable Solutions Group | $486M | flat | -3% | ||

Breaking issues down on a gaggle foundation, there are a few main factors to instantly take away. The first is that, whereas nonetheless recorded per Generally Accepted Accounting Principles (GAAP) guidelines, Intel is all however prepared to chop unfastened its NAND reminiscence enterprise, which it’s within the means of promoting to SK hynix. That mentioned, the deal has not been permitted and a time limit has not been set, so whereas Intel is opting to exclude it from their non-GAAP outcomes (and future enterprise projections), they aren’t freed from it fairly but.

Second, that is the primary full quarter that can be utilized for year-over-year comparisons with the coronavirus pandemic. While Intel’s manufacturing aspect has lengthy since stabilized there, year-over-year numbers are typically in odd locations because the demand combine a 12 months in the past was very uncommon, to place it mildly.

For Q2, Intel’s Client Computing Group was as soon as once more the most important winner; that division pulled in $10.1B in income, and is up 6% YoY. According to Intel, each laptop computer and desktop income is up, as Intel has surpassed transport 50 million Tiger Lake processors. That mentioned, these income positive aspects are largely volume-driven; ASPs for each desktop and cellular are down, due partly to what Intel is noting to be elevated gross sales of low core rely processors. Intel’s enhancing fab state of affairs has additionally performed an element right here – in response to the corporate, 10nm manufacturing prices have dropped, serving to to enhance the division’s working earnings.

Meanwhile Intel’s Data Center Group is absolutely beginning to really feel the affect of the more and more aggressive server surroundings. While income was up 16% versus Intel’s robust Q1, it’s nonetheless down 6% on a yearly foundation. Breaking that down additional,…

![[Video] Reimagined for Orchestra, ‘Over the Horizon 2026’](https://loginby.com/itnews/wp-content/uploads/2026/02/Video-Reimagined-for-Orchestra-‘Over-the-Horizon-2026’-100x75.jpg)