![]()

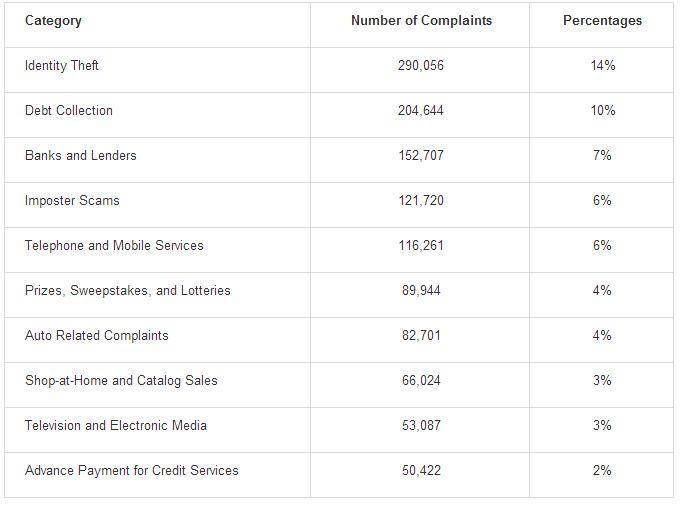

Once again, identify theft is the most reported type of fraud in the United States, according to a new Federal Trade Commission (FTC) report. Out of the more than 2 million complaints cataloged by the FTC in 2013, nearly 300,000 of them involved identify theft. Since 2006, this type of fraud has continuously come in at the top of the list.

Even though the number of identity theft complaints in 2013 decreased in comparison to the 369,132 complaints the FTC received in 2012, overall fraud has continued to cost victims more each year. The FTC reports that fraud cost people as much as $ 1.6 billion in 2013.

At The Top

With the majority of fraud resulting from e-mails and phone calls, it is remarkably easy for someone to scam an unsuspecting victim. Criminals are able to use stolen credit cards and withdraw money from bank accounts once they have assumed people’s identities. As a result, the losses incurred by victims of identity theft average out to $ 2,294, according to the FTC.

Although fraud is an issue around the world, the FTC noted that there is a difference in the rate of fraud among U.S. states. Florida has the highest rate of fraud per capita at 804.9 people out of every 100,000. On the other hand, North Dakota has the least amount of reported fraud, with 270.9 people out of every 1,960 affected.

Identity theft may be number one, but there are still hundreds of thousands of people who are forced to deal with damages resulting from other types of fraud, according to the FTC. Debt collection scams were second on the list, with 204,644 complaints received last year.

Protecting Yourself

Even though there are millions of people that file fraud-related complaints with the FTC every year, 44 percent of them do not incur any losses. This usually means that these people knew how the handle such situations correctly.

As the FTC is in charge of dealing with identity theft, it includes numerous tips on its Web site to help people identify scams and deal with identity theft after it occurs. “[Identity thieves] can drain your bank account, run up charges on your credit cards, open new utility accounts, or get medical treatment on your health insurance.” said the FTC.

Unlike with other types of fraud, dealing with identity theft is usually a responsive measure meaning that it is important to report an issue as soon as it is discovered. The FTC said, “If you take action quickly, you can stop an identity thief from doing more damage.”

Among the steps recommended are placing an initial fraud alert on your credit card and bank accounts, ordering credit reports, and creating an identity theft report. By following these steps and filing the correct paperwork, it is possible to significantly reduce the harm that a thief can do.

NewsFactor Network