IC testing homes poised for strong gross sales in 1Q20

Julian Ho, Taipei; Steve Shen, DIGITIMES

While the total impacts of the coronavirus outbreak stay unsure, Taiwan-based wafer probing and IC testing answer suppliers are set to brace for strong gross sales within the first quarter of 2019, based on trade sources.

Orders for wafer probing and IC-testing options for 5G, Wi-Fi 6 and RF gadgets, base stations in addition to CMOS picture sensors are anticipated to come back in important volumes within the first quarter of 2020, stated the sources.

IC backend service supplier King Yuan Electronics (KYEC) posted revenues of NT$2.223 billion (US$ 74.25 million) in February. Although the figures had been down barely from the earlier month, they had been higher than anticipated, stated the sources.

KYEC is predicted to land important testing orders for 5G chips resulting from continued efforts in China developing 5G infrastructure, and see its gross sales momentum proceed into October of the 12 months, added the sources.

Efforts by OmniVision, Sony and Samsung Electronics to additional improve their market positions within the CIS sector can even profit KYEC when it comes to gross sales growth, the sources stated.

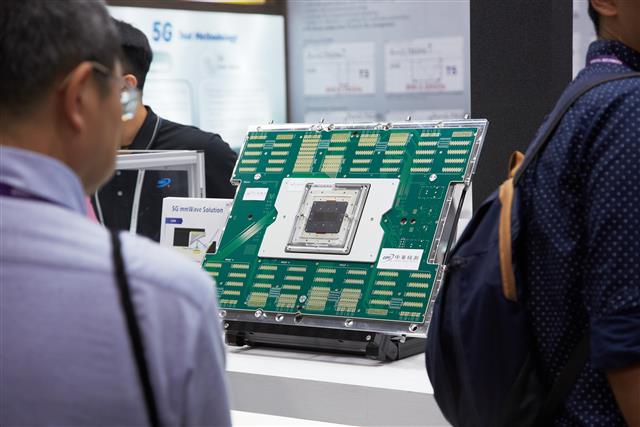

Chunghwa Precision Test Tech (CPTT) will garner wafer probing answer orders from plenty of purchasers together with Apple, Qualcomm, Hisilicon Technologies and MediaTek, whereas fellow firm Keystone Microtech can even safe Wi-Fi 6 interface testing orders from MediaTek and Realtek Semiconductor, famous the sources.

Sigurd Microelectronics is predicted to land growing testing service orders for 5G, RF, networking chips and energy administration (PWM) chips from Hisilicon, RichWave and different IC distributors, indicated the sources.