HPE Buys Cray, Seeks Return to HPC Relevance–Again

NEWS ANALYSIS: On paper, HPE’s buy of Cray for about $1.three billion makes eminent strategic sense. But it stays to be seen as as to if the merger works the best way it was drawn up.

The success of company acquisitions is rarely assured. Too many issues can go incorrect. Deals usually look higher on paper than they do in actual life. Planned methods falter. Hoped-for synergies are DOA. Executive energy performs trigger long-range harm. Key workers really feel unloved and search greener pastures.

Plus, there’s easy poor planning or execution. An buying firm could consider that the article of its attentions provides belongings, folks and capital that may assist its personal endeavors. But, after the deal is completed, it by no means correctly or absolutely does what’s vital to realize the total advantages of the funding. The sensible impact is the enterprise equal of a sugar rush. A number of months of “Whoa, mama! How fast can this sucker go?” ending with a “Thelma and Louise”-style flameout.

It occurs to even extremely profitable firms, usually repeatedly, with Hewlett Packard Enterprise (HPE) being a notable instance. Though its current buy of legendary supercomputing chief Cray has been broadly lauded, the historical past of HPE’s acquisitions suggests a extra cautious strategy is warranted, particularly relating to supercomputing. Let’s contemplate that extra intently.HPE and Cray: The Pitch

On paper, HPE’s buy of Cray for about $1.three billion makes eminent strategic sense. According to Antonio Neri, HPE’s president and CEO: “By combining our world-class teams and technology, we will have the opportunity to drive the next generation of high-performance computing and play an important part in advancing the way people live and work.”

Consider the acquisition-first phrases of the general market. In asserting the Cray deal, HPE cited analysis suggesting that prime efficiency computing (HPC) system gross sales, together with related storage and providers, is predicted to increase at a 9% CAGR to about $35 billion in 2021. Plus, in the course of the coming half decade, greater than $four billion will likely be awarded (often by authorities companies or analysis establishments) for enormous exascale HPC installations.

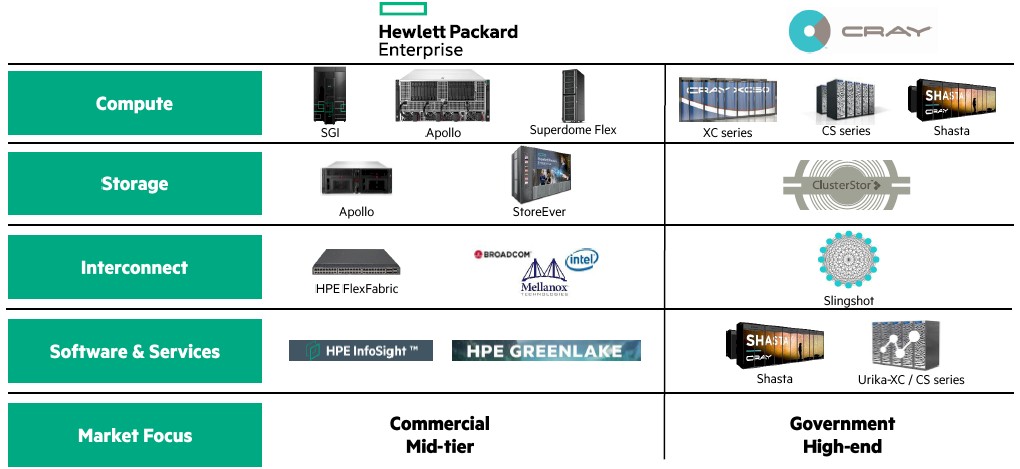

Those are enticing alternatives, and proudly owning Cray is definite to enhance HPE’s aggressive outlook. Why so? Mainly as a result of Cray is a standout in present high-end HPC techniques. In the latest (November 2018) Prime500 listing of the world’s quickest supercomputers, Cray applied sciences account for 51 installations. But greater than half of these (26) are within the high 100 techniques, fifteen are within the high 50, 5 are within the high 20 and three are within the high 10. Moreover, its success in high-end installations and technological excellence make Cray the main Prime500 vendor when it comes to its listed techniques’ mixed efficiency.

Cray additionally has a bunch of applied sciences and commitments of worth to HPE. The firm’s new Shasta system structure and Slingshot interconnect are central to the $600M+ exascale supercomputer contract that the corporate and AMD have been lately awarded by the U.S. Department of Energy’s (DoE’s) Oak Ridge National Laboratory. Cray was additionally a part of an award (with Intel) for an exascale contract from the U.S. DoE’s Argonne National Laboratory, with Cray’s portion valued at greater than $100 million.

In different phrases, for a modest (at the least by current IT…

![[Video] Reimagined for Orchestra, ‘Over the Horizon 2026’](https://loginby.com/itnews/wp-content/uploads/2026/02/Video-Reimagined-for-Orchestra-‘Over-the-Horizon-2026’-100x75.jpg)