The proper individuals to resolve the trillion greenback scholar debt disaster is likely to be those who’re affected by it the toughest.

If you’re a current faculty graduate, there’s a 50 % likelihood you took on debt while you moved off campus. If you’re like the typical scholar borrower, you graduated with $29,800 of mortgage debt, and are making a month-to-month re-payment of between $200 and $300, based on a current report from the New York Fed.

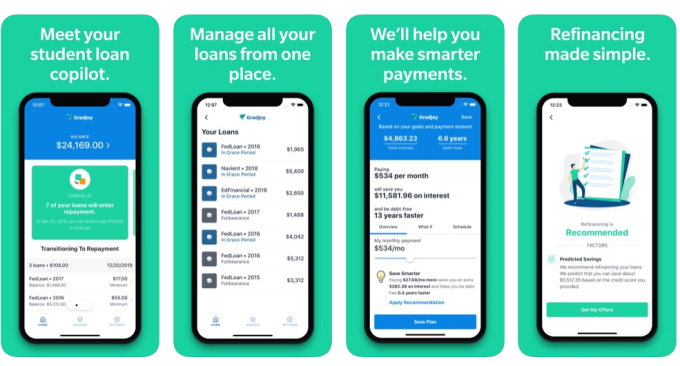

Gradjoy is a brand new Y Combinator-backed startup that desires to assist the 45 million scholar debt debtors within the U.S. handle their reimbursement plans. Within seven days of being a dwell platform and a advertising technique that consisted of reaching out to a couple universities, Gradjoy is already managing $20 million in loans.

Co-founders Jose Bethancourt and Marco del Carmen turned down roles at Cloudflare and MongoDB, respectively, upon studying they’d been accepted to Y Combinator’s Summer 2019 class. Gradjoy payments itself as a “student loan co-pilot,” and presently exists a platform that helps customers handle scholar mortgage repayments – whether or not that’s assessing execs and cons of refinancing, what a month-to-month fee ought to appear to be, and if they’ve any wiggle room primarily based on higher revenue and spending habits. Gradjoy hopes to hammer just a few cracks within the $1.5 trillion federal scholar mortgage debt disaster by giving new debtors extra perception into their reimbursement journey.

Loan corporations will all the time advise debtors to pay the minimal as a result of they profit from the outrageous curiosity charges amassed over time. Gradjoy needs to faucet into your checking account and monitor your funds to ship extra clear loan-management recommendation with a characteristic that permits you to simulate how completely different fee quantities would have an effect on your loans.

Bethancourt, a current University of Texas graduate, was his personal first person. He constructed the Gradjoy platform for himself whereas calculating his optimum scholar mortgage reimbursement plan in Excel. He’d met his co-founder in a coding bootcamp within the Rio Grande Valley on the border of Mexico and South Texas – the place Bethancourt is initially from.

Jose Bethancourt (Left) Marco del Carmen (Right)

Student lending is a predatory business that advantages off the ignorance of first-time debtors and has been recognized to purposefully constrict sources for patrons. New debtors should navigate landmines like refinancing scams, the “7 minute rule” for customer support help and tough necessities buried inside the public service mortgage forgiveness program.

A query is posed for brand spanking new startups that need to punch up towards grasping scholar mortgage servicers like Navient and AES. Without replicating the corrupt enterprise fashions that lenders have with a purpose to make cash off the scholar mortgage debt downside, how can newcomers like Gradjoy flip worthwhile?

Gradjoy payments itself as a “student loan co-pilot.”

Aside from enterprise capital, which Gradjoy can be searching for upon its commencement from Y Combinator, will make cash in just a few methods. In order to align with customers’ objectives, Gradjoy’s enterprise mannequin is tied to their financial savings. If a person refinances utilizing GradJoy, they get a referral fee from their lending companions. The platform is presently beta testing their robo-advisor for debt, and sooner or later they plan on charging a small price per thirty days in the event that they’re capable of save a person cash.

Student loans don’t solely burden millennial financial institution accounts. The scholar mortgage debt disaster is creating an financial pattern. Inability to repay scholar loans causes younger individuals to depend on bank cards to make ends meet and delay main life decisions like investing in property. Not to say the have an effect on of scholar debt on psychological well being for younger individuals at an already-volatile level of their lives.

In 5 years, Gradjoy’s founders say they’d prefer to be operating a extra strong monetary providers product that was first centered on serving to its prospects repay scholar loans. They hope to mobilize prospects whereas they’re on the nascence of…

![[MWC 2026] A Sound Immersion Experience With Galaxy Brings](https://loginby.com/itnews/wp-content/uploads/2026/03/1772736146_MWC-2026-A-Sound-Immersion-Experience-With-Galaxy-Brings-100x75.jpg)