Stock in lots of American firms, like Amazon, Alphabet or Tesla, can host a whole lot or 1000’s of {dollars} per share. Fractional buying and selling, or shopping for a part of a single share via a brokerage, makes them extra accessible—at the very least to folks inside the United States. Investors in different nations, nevertheless, typically need to pay excessive charges via interactive brokers. Gotrade makes fractional buying and selling of U.S. shares obtainable to folks in 150 nations, and prices a minimal of only one greenback.

The Singapore-based startup introduced it has raised $7 million in seed funding led by LocalGlobe, with participation from Social Leverage, Y Combinator, Picus Capital and Raptor Group. The spherical additionally included angel buyers like Matt Robinson, co-founder of GoCardless; Carlos Gonzalez-Cadenas, former chief product officer of Skyscanner; Frank Strauss, former head of Deutsche Bank’s world digital enterprise; and Joel Yarbrough, Asia-Pacific head at Rapyd.

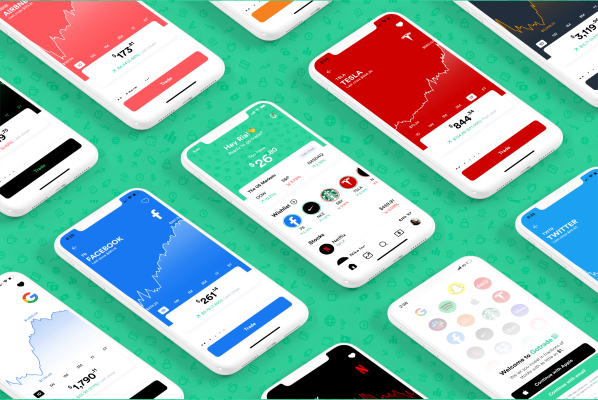

GoTrade was based in 2019 by David Grant, Norman Wanto and Rohit Mulani. Its app launched three months in the past and is at the moment invite-only. Gotrade claims sign-ups have grown 20% week-on-week, and it now has greater than 100,000 customers unfold internationally. About 65% of Gotrade’s customers have traded shares earlier than, whereas the remaining are first-time buyers.

Mulani, the corporate’s chief government officer, advised TechCrunch that the thought for Gotrade was planted when he grew to become focused on American shares, however found many limitations to buying and selling.

“When I was 18, I actually looked to get access in Singapore, and banks were charging $30 per trade. Effectively, the market taught me that I could not get into the market. Fast forward ten years, I decided to look into it again, and the banks were still charging $25 a trade,” he stated. “On top of that, their user interfaces were something I didn’t want to look at. So we decided to build a brokerage platform where anyone can get access.”

“Fractional trading actually came a bit later,” he added. “That was the real MVP for us because fractional really makes investing accessible to anyone globally since all you need is one dollar.”

Robinhood, SoFi and Stash all characteristic fractional buying and selling, however Mulani stated these apps are primarily utilized by U.S. residents. On the opposite hand, Gotrade will not be obtainable to U.S. residents due to monetary laws, so its fundamental rivals are interactive brokers, Saxo Bank and eToro.

Gotrade doesn’t cost fee, custody, inactivity or dividend charges. Instead, it monetizes by amassing a small price on the forex change from deposits, and curiosity generated from uninvested money in brokerage accounts. The app is free to make use of, however plans so as to add a premium paid subscription program and digital debit card that customers can hyperlink to their accounts.

Many of Gotrade’s customers are individuals who have invested of their native inventory markets, however weren’t in a position to commerce U.S. shares earlier than. They fluctuate extensively in age, however 25 to 34-year-olds are the app’s largest phase, and the common account measurement is about $500.

Gotrade acts as an introducing dealer to Alpaca Securities LLC, a U.S. inventory brokerage that’s regulated by the Financial Industry Regulatory Authority (FINRA) and serves as an middleman. Alpaca Securities splits its inventory stock into fractions, and Gotrade customers can resolve what number of fractions they wish to purchase. The app additionally permits them to set a funds, and mechanically calculates the quantity of fractional shares they will afford via notional worth buying and selling.

User accounts are protected as much as $500,000 by the Securities Investor Protection Corporation (SIPC), and cash goes via counterparties regulated in Singapore, like Rapyd, and the United States, together with Alpaca and First Republic Bank. To shield customers, Gotrade works solely with fully-funded money accounts with none margin facility. Mulani defined {that a} margin account successfully means individuals are borrowing cash to take a position, whereas a fully-funded…