What a busy week on the earth of media liquidity.

That’s a sentence you don’t get to jot down typically. Regardless, information broke this week that Axel Springer is shopping for U.S. political journalism outfit POLITICO. The transaction was anticipated, however the eye-popping roughly $1 billion price ticket nonetheless has tongues wagging. We even acquired on the podcast to talk about it.

And Forbes introduced that it’s going public through a SPAC. The enterprise publication’s information follows BuzzFeed’s journey to the general public markets by a blank-check firm. Hot media liquidity summer season? Something like that.

The Exchange explores startups, markets and cash.

Read it each morning on Extra Crunch or get The Exchange publication each Saturday.

That TechCrunch is within the technique of being offered to non-public fairness, in fact, isn’t one thing that we should always overlook. Shoutout to the Verizon bankers who discovered a option to do away with us whereas additionally deleveraging Verizon’s debt profile. Ten factors.

I wish to take a fast tour of the Forbes SPAC deck this morning. Our notes on BuzzFeed’s are right here, in case you wish to run comparisons. This will likely be simple and enjoyable. Perfect Friday morning fare. Into the info!

I wish to take a fast tour of the Forbes SPAC deck this morning. Our notes on BuzzFeed’s are right here, in case you wish to run comparisons. This will likely be simple and enjoyable. Perfect Friday morning fare. Into the info!

What’s it value?

In corporate-speak, Forbes Global Media Holdings is merging with blank-check firm Magnum Opus Acquisition Limited. The transaction will shut both This autumn 2021 or Q1 2022, Forbes estimates.

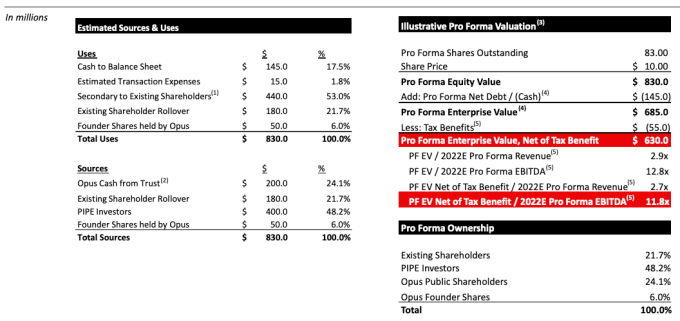

The deal itself is considerably modest in scale in contrast with different SPAC offers we’ve lately appeared into. Forbes stories that it’ll sport “an implied pro forma enterprise value of $630 million, net of tax benefits,” after its completion. Some $600 million in gross proceeds will likely be derived from Magnum Opus funds “and $400 million of additional capital through a private placement of ordinary shares of the combined company,” Forbes writes.

The firm will sport an fairness valuation of $830 million after the deal closes, per its personal calculations. That quantity will change some relying on redemptions forward of the mixture. The hole between the massive {dollars} going into the deal and the modest last valuation of the general public Forbes entity is because of some $440 million in secondary transactions for present Forbes shareholders.

In case you’d want all of that in desk kind, right here’s the Forbes investor deck:

Image Credits: Forbes SPAC deck

Is $830 million a good worth? Let’s dig into Forbes’ outcomes.

![[Video] Reimagined for Orchestra, ‘Over the Horizon 2026’](https://loginby.com/itnews/wp-content/uploads/2026/02/Video-Reimagined-for-Orchestra-‘Over-the-Horizon-2026’-100x75.jpg)