Fidel, the U.Ok.-headquartered startup that gives an API to let builders construct performance, reminiscent of rewards, on prime of the key card cost networks, has raised $18 million in Series A funding.

The fairly sizeable spherical is co-led by U.S.-based fintech funds Nyca Partners and QED Investors. Also collaborating are Citi Ventures, Commerce VC, Elefund, Horizons Ventures, RBC Ventures Inc. (a subsidiary of Royal Bank of Canada), and 500 Startups. Several angel buyers additionally joined in, reminiscent of Cris Conde, former CEO of Sungard, and Taavet Hinrikus, founding father of TransferWise.

Meanwhile, Hans Morris, former President of Visa and Managing Partner of Nyca Partners, and Yusuf Ozdalga, Partner at QED Investors, will be part of the corporate’s board.

Fidel says the brand new funding shall be used to broaden the Fidel crew and help the corporate’s progress, product improvement and worldwide ambitions in North America, the Nordics and APAC.

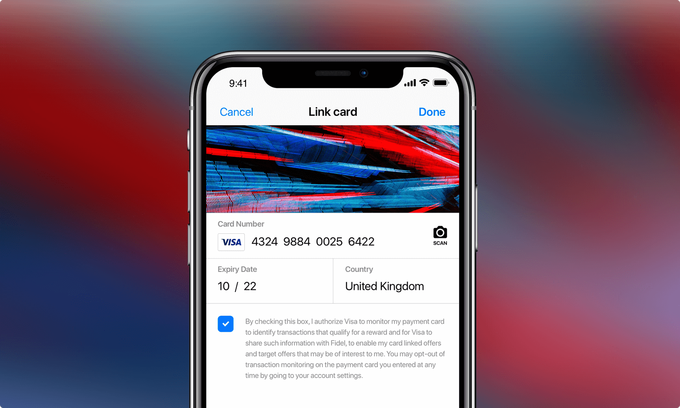

Working in partnership with Mastercard, Visa and American Express, put merely Fidel has developed a set of APIs that make it straightforward to hyperlink a person’s cost card to an app. This implies that builders are in a position to construct card-linked functions “in a matter of minutes,” reminiscent of loyalty-based rewards and extra modern use-cases afforded by entry to the real-time knowledge that card cost networks can present.

Not solely does Fidel provide a single level of integration — because of its partnerships with all three card networks — however the firm additionally removes the burden of regulatory compliance from its prospects by securely tokenising card numbers. “All of this helps businesses get to market and scale faster,” says Fidel co-founder and CEO Subrata Dev.

“Card-linking is the optimal choice for any user journey that relies upon real-time payment information, location accuracy and a frictionless customer experience,” he says. This contains loyalty, digital receipts, PFM/expense administration, and “online-to-offline attribution”.

Loyalty is at the moment Fidel’s predominant use case. This sometimes sees a person signal as much as a loyalty program, the place they will earn factors, rewards and money again mechanically after they pay utilizing a registered card. It’s the card-linking side that Fidel makes doable, no matter what kind of card it’s and who the person banks with. Of course, with any such loyalty app, playing cards are solely linked when a person opts in.

One instance of Fidel-powered card-linking is the British Airways Executive Club app that lets members earn Avios factors mechanically after they store with any linked credit score or debit card at collaborating retailers.

Dev tells me the advantages of utilizing Fidel as an alternative of “open data sources” enabled via Open Bankking/PSD2 is that card community knowledge is real-time and granular. In distinction, checking account knowledge, particularly that provided by legacy banks as apposed to challengers, will be gradual and fairly restricted.

“We are able to see specific information including – crucially – location, in real-time, which is pivotal to many use cases,” he explains. “Open data sources typically provide much lower quality data, even once scraped. Card-linking is also frictionless for the user, who registers their card once and shops as usual. Again, this is key for loyalty and retention use cases where open banking’s requirement for customers to re-authenticate every 90 days would cause far too much friction and dropout”.

With that stated, because it stands, Dev says that Fidel hardly ever competes towards Open Banking API options, as the selection of information supply is mostly depending on the precise use case. “Many of our customers are using a combination of the two sources to gather a more holistic view and create better user experiences,” he provides. “So whilst there may be some level of overlaps, account-linking and card-Linking are largely complementary”.