Just a few years in the past, you couldn’t go to a fintech meetup with out ending up in a dialog about embedded finance. In 2020, we even wrote that embedded finance may signify fintech’s future.

The distribution technique lets fintech corporations combine their providers into different services and products, which in flip offers customers entry to new options with out having to enroll to a brand new service. It’s confirmed an particularly engaging method for fintechs because it offers them a brand new layer of merchandise to supply to larger banks and monetary providers suppliers.

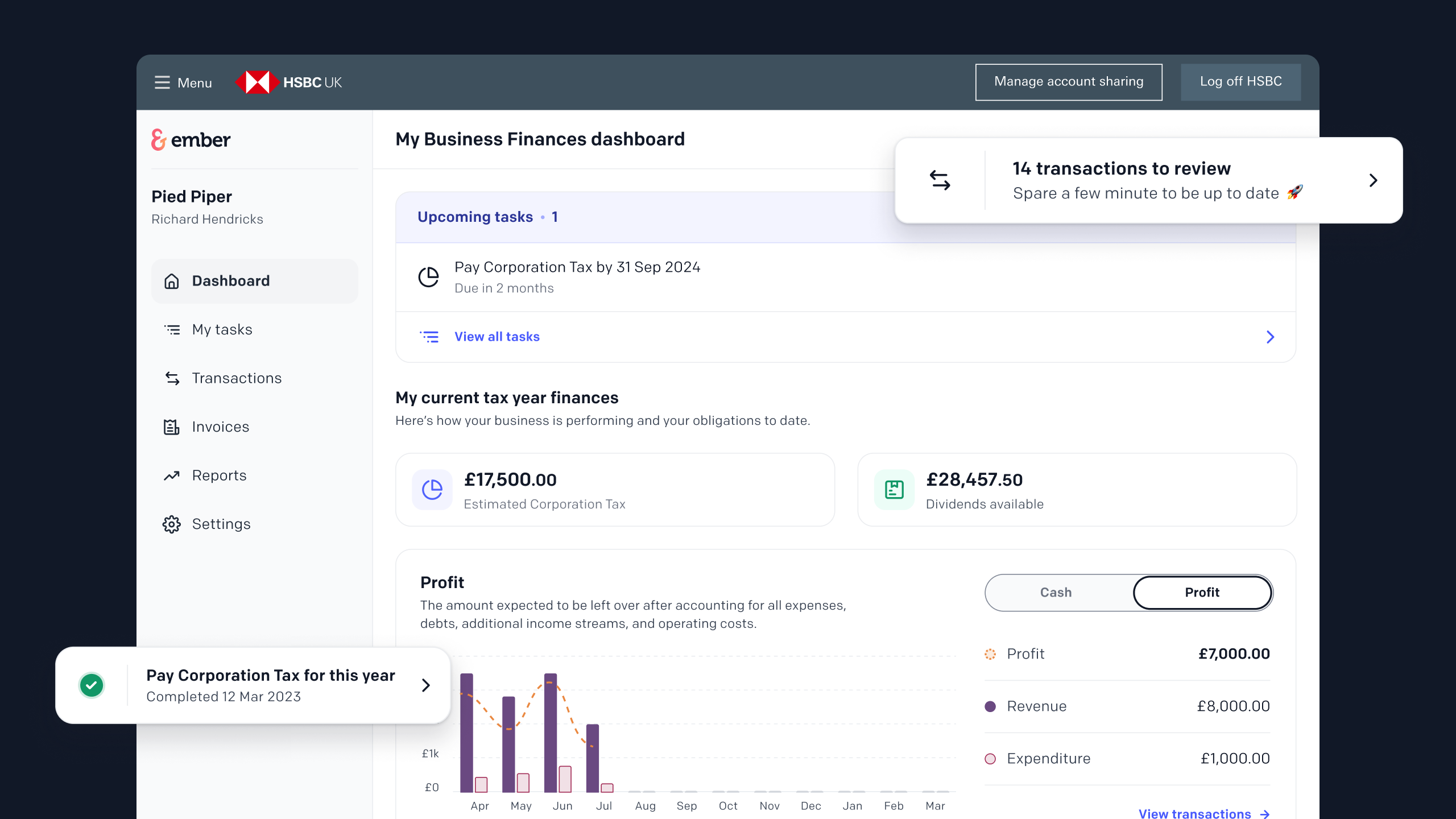

Ember, a British startup engaged on an embedded tax providing, is proving that the technique continues to be a sound one in 2024. The small firm has partnered with HSBC within the U.Ok. in order that the financial institution’s enterprise prospects can entry Ember’s providers from their on-line accounts. Ember might probably achieve 1000’s of shoppers with a single partnership.

Ember’s service fetches corporations’ latest banking transactions and routinely categorizes them. After that, prospects can monitor bills, add receipts, create invoices and do primary accounting.

Ember then offers an summary of your organization’s income and expenditure, estimates how a lot you’re going to pay in taxes, and tells you the way a lot cash is obtainable to withdraw as dividends for the homeowners.

Bigger corporations will doubtless work with chartered accountants instantly and even rent in-house accountants. But freelancers and small corporations with lower than 10 staff might not less than simplify their accounting processes with Ember’s self-serve product.

“The likes of Xero, QuickBooks, FreeAgent are all built for accountants and not end business owners. And we saw a huge opportunity to build a transformative experience for an end business owner to look after their entire suite of tax obligations,” Ember’s co-founder and COO, Daniel Hogan, informed TechCrunch.

However, the problem is that this market is extraordinarily fragmented. There are a whole bunch of 1000’s of small corporations within the U.Ok. alone, that means that it’s exhausting to get prospects.

“We were going up against the likes of Xero and QuickBooks on advertising spend, and that was tricky to acquire customers directly because of that exact reason — it was expensive,” Hogan mentioned.

That’s why Ember has began negotiating with massive banks like HSBC UK to supply an embedded resolution. HSBC pays Ember for every of its prospects who chooses to make use of Ember’s options, and in the event that they wish to entry extra options, equivalent to the flexibility so as to add different financial institution accounts from different monetary establishments, they will pay Ember to do this.

Ember additionally has a crew of in-house accountants who can deal with advanced duties for paid prospects, equivalent to end-of-year annual accounting and company tax administration. Ember’s free-to-use model that you just get on HSBC’s on-line banking portal acts as the highest of the funnel for the startup to accumulate paying purchasers.

Ember isn’t going to work solely with HSBC going ahead. Contracts with massive banks take a very long time to barter, however hopefully the corporate can have one other associate financial institution to announce quickly.

With upcoming regulatory modifications within the U.Ok. (“making tax digital”), accounting software program will doubtless obtain elevated curiosity from small companies. By 2026, round 1.75 million enterprise homeowners within the nation must change the way in which they file their taxes. The overwhelming majority of them don’t use any accounting service to assist them with this course of.

“[HM Revenue and Customs] has essentially made the decision to be an API-first organisation. So rather than building it themselves, they’re relying on the software providers, such as ourselves, to actually build all of that experience. They’re just being the API layer,” Hogan mentioned.

“They’re relying on us to build better user experiences to help customers report both more frequently as well as more accurately.”

In addition…