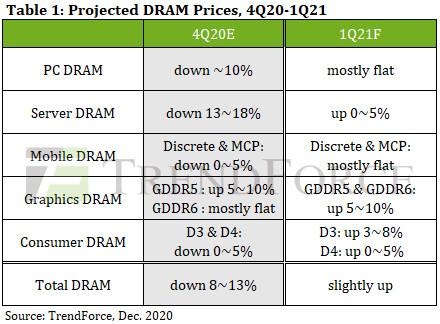

PC DRAM costs shall be principally fixed as pocket book (NB) producers enhance procurement actions in response to hovering NB cargo

Regarding the NB market and its affect on PC DRAM demand, whole NB manufacturing is predicted to say no by 9% QoQ to achieve 52.7 million items in 1Q20 because of the conventional low season and the discount of labor days brought on by the celebration of the Lunar New yr, in addition to the truth that 4Q20 was a comparatively excessive base interval for comparability. On the opposite hand, 2020 has been a good yr for PC OEMs with the annual whole NB shipments projected to develop by 20%. This implies that PC OEMs shall be holding a comparatively low degree of DRAM stock in 1Q21 (i.e., 4 to 5 weeks). To meet and maintain the demand for NBs, PC OEMs will most likely proceed with their stock constructing within the brief time period. Regarding the provision of PC DRAM, the three dominant DRAM suppliers (Samsung, SK Hynix, and Micron) haven’t considerably raised bit output for practically two quarters. Furthermore, they’ve been allocating extra manufacturing capability to cell DRAM for the reason that finish of 3Q20 because of the latest demand upswing in that software section. Hence, manufacturing capability has tightened for each PC DRAM and server DRAM. Moving to 1Q21, PC DRAM provide shouldn’t be anticipated to develop noticeably, whereas DRAM demand from PC OEMs will stay wholesome. TrendForce due to this fact believes that the downward trajectory of the ASP of PC DRAM merchandise shall be more and more tough to keep up.

Owing to the facility outage at Micron’s Taiwan-based fab and the general constrained manufacturing capability, server DRAM value forecast for 1Q21 has been revised from comparatively flat to barely rising

Demand-wise, the primary quarter is the standard low season for OEMs of digital merchandise. As such, server procurement tends to be at its lowest degree within the first quarter as effectively in comparison with the next three quarters of the yr. However, there may be the distinct risk that prospects within the knowledge middle section will construct up their inventories forward of time throughout 1Q21 as a result of they anticipate a normal value rally afterward. Supply-wise, the three dominant suppliers have been assigning extra manufacturing capability to cell DRAM since this September as this software section has lately skilled a requirement restoration. The shift of their product mixes is having the identical impact on the provision of each server DRAM and PC DRAM, so the provision bit progress of server DRAM shall be very restricted in 1Q21.

There is a rising consensus amongst reminiscence consumers that stocking up early is the most effective technique as costs are near bottoming out and the DRAM trade’s manufacturing capability has change into extra restricted. In 1Q21, seasonal headwinds will have an effect on shipments for OEMs of digital merchandise. However, the demand facet of the DRAM market is predicted to be very energetic. Memory consumers will possible fill up forward of time as a result of the worth rebound may occur at any second, particularly after the facility outage of MTTW (Micron’s Taiwan-based DRAM fab). The downtrend in DRAM costs are actually led by a number of product strains. With the latest demand restoration for cell DRAM…