Cross-border funds for companies in rising markets stay considerably untapped, regardless of small to massive companies utilizing banks and legacy fintechs to transact trillions of {dollars} in transaction quantity yearly.

A report by Airwallex forecasts that the worth of cross-border funds will develop by 60%, reaching $250 trillion by 2027. Between 2018 and 2022, the worth of such funds elevated by $25 trillion to $150 trillion, with business-to-business (B2B) funds making up 97% of that quantity.

For years, most companies have relied on conventional banks, however excessive prices and gradual processes are pushing some to undertake fintech options that promise decrease prices and quick settlements. One such platform is Conduit. The B2B cross-border funds platform discovered success after pivoting from crypto to conventional banking and is now making inroads in Africa, the place companies face many related challenges to the startup’s first markets in Latin America, following a $6 million seed extension from Helios Digital Ventures, the enterprise capital arm of Helios Investment Partners.

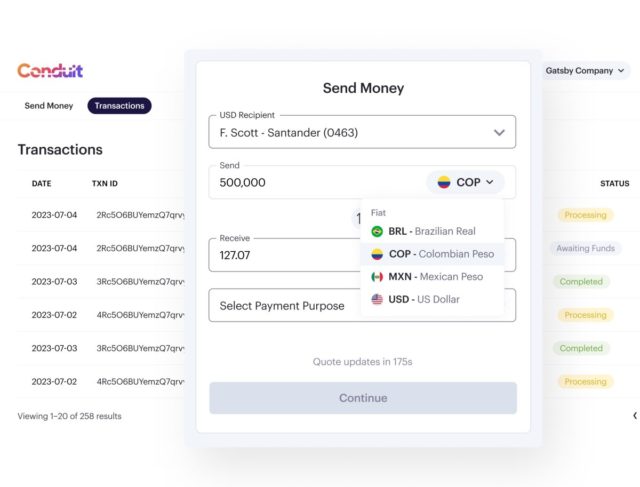

Conduit says companies on its platform will pay US {dollars} on to financial institution accounts by way of ACH or SWIFT, even with no U.S. entity. It started providing funds to companies in Latin America final August.

Initially launched as an API to attach fintechs, neobanks, and legacy monetary establishments with crypto-backed incomes merchandise, Conduit wished to bridge conventional finance with decentralized finance (DeFi). The fintech, backed then by $17 million in seed funding from buyers like Portage Ventures, Diagram Ventures, and Gradient Ventures, developed analytics instruments for institutional buyers in DeFi.

From DeFi to TradFi

However, after the crypto market downturn of 2022 — marked by the collapse of Terra, Luna, FTX, and others — Conduit realized its preliminary mannequin was unsustainable, and pivoted to give attention to B2B cross-border funds. “After over a year of searching for the right product-market fit, we found it in B2B cross-border payments,” co-founder and CEO Kirill Gertman informed TechCrunch in an interview.

In August 2023, Conduit launched its B2B cross-border funds platform for companies in Latin America, recognizing the numerous challenges companies in international locations like Colombia, Brazil and Mexico face when attempting to hook up with the worldwide monetary system. Many of those companies battle with entry to {dollars}, dependable SWIFT connections, and different important fee rails. The state of affairs is analogous in Africa, the place companies in international locations like Kenya and Nigeria additionally encounter these difficulties.

“We identified this as a much more pressing and tangible pain point than the bubble of decentralized finance. These are real-world issues faced by traditional businesses that need a better, faster, and more transparent way to transact with their suppliers and partners across borders,” Gertman remarked.

Despite the promise of DeFi and stablecoins like USDC or USDT, the sensible challenges stay important. Most companies nonetheless have to convert stablecoins into native currencies to handle lease, salaries, and different operational prices.

While Conduit nonetheless helps bridge this hole by facilitating these conversions, permitting companies to off-ramp stablecoins into native currencies the place wanted, Gertman shortly factors out that Conduit is now a lot nearer to a standard fintech.

Moving cash for companies within the Global South

In Latin America, the place Conduit began, firms like Caliza and Mundi additionally present cross-border funds, forex change, and dealing capital options. Yet, Gertman says Caliza doesn’t see different fintechs because the competitors, however fairly international locations’ native banks and their methods’ entrenched practices and limitations.

Take Brazil and Nigeria for instance. These international locations have environment friendly on the spot fee methods like Pix and NIP for home transactions; nevertheless, worldwide transfers…