- Register

- Login

36°C

- Article

- . (0)

- Related content

- Company info

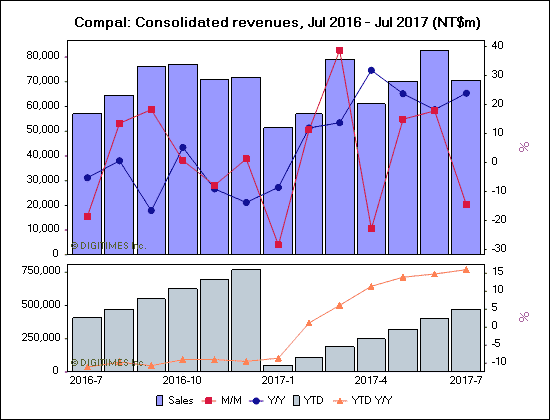

Compal Electronics has reported consolidated revenues of NT$70.523 billion (US$2.33 billion) for July 2017, representing a 14.63% drop on month and 23.86% increase on year.

The notebook ODM has totaled NT$471.712 billion in year-to-date revenues, up 16.04% compared with the same time last year.

For the year of 2016, Compal totaled NT$766.811 billion in consolidated revenues, down 9.49% sequentially on year.

|

Compal: Consolidated revenues, Jul 2016 – Jul 2017 (NT$m) |

|||||

|

Month |

Sales |

M/M |

Y/Y |

YTD |

Y/Y |

|

Jul-17 |

70,523 |

(14.6%) |

23.9% |

471,712 |

16% |

|

Jun-17 |

82,606 |

17.8% |

18.2% |

401,188 |

14.8% |

|

May-17 |

70,121 |

14.9% |

23.7% |

318,583 |

13.9% |

|

Apr-17 |

61,033 |

(22.9%) |

31.8% |

248,461 |

11.4% |

|

Mar-17 |

79,115 |

38.7% |

13.7% |

187,428 |

6.1% |

|

Feb-17 |

57,034 |

11.2% |

11.9% |

108,313 |

1.2% |

|

Jan-17 |

51,279 |

(28.5%) |

(8.6%) |

51,279 |

(8.6%) |

|

Dec-16 |

71,669 |

1.2% |

(13.8%) |

766,811 |

(9.5%) |

|

Nov-16 |

70,813 |

(7.9%) |

(9.1%) |

695,142 |

(9%) |

|

Oct-16 |

76,880 |

0.7% |

5.2% |

624,329 |

(9%) |

|

Sep-16 |

76,347 |

18.2% |

(16.6%) |

547,449 |

(10.7%) |

|

Aug-16 |

64,599 |

13.5% |

0.6% |

471,102 |

(9.7%) |

|

Jul-16 |

56,939 |

(18.6%) |

(5.3%) |

406,503 |

(11.1%) |

*Figures are consolidated

Source: TSE, compiled by Digitimes, August 2017

-

Giantplus reports earnings for 2Q17

Displays | 9h 11min ago

-

Qisda nets NT$1.32 per share for 1H17

IT + CE | 9h 14min ago

-

Accton profits soar in 1H17

Mobile + telecom | 9h 21min ago

-

Lite-On Semi July revenues increase

Bits + chips | 10h 54min ago

-

UMC, VIS July revenues down

Bits + chips | 10h 57min ago

-

Taiwan market: Huawei introduces multiple new products

Before Going to Press | 9h 33min ago

-

ITRI, Oxford Instruments team up for equipment development

Before Going to Press | 9h 34min ago

-

Asustek reports decreased sales for July

Before Going to Press | 9h 36min ago

-

Osram begins second-phase construction at Wuxi plant

Before Going to Press | 9h 36min ago

-

Taiwan market: Hojin introduces smartphone for seniors

Before Going to Press | 11h 7min ago

-

Intel to launch 12-core Skylake-X CPU in late August

Before Going to Press | 11h 8min ago

-

Coretronic acquires Calibre

Before Going to Press | 11h 8min ago

-

Taiwan solar firms about to form PV module JV

Before Going to Press | 11h 17min ago

-

ChipMOS obtains backend orders from Novatek

Before Going to Press | 11h 18min ago

- China AMOLED panel capacity expansion forecast, 2016-2020

This Digitimes Research Special Report examines the China AMOLED industry, focusing on the expansion capacity of the makers, the current implementation plans of major smartphone vendors in the market and the technological hurdles faced by the China makers.

- Taiwan server shipment forecast and industry analysis, 2017

Digitimes Research estimates that revenues from sales of server motherboards, servers, storage systems and related network system equipment by Taiwan-based vendors reached NT$555.8 billion in 2016 and the amount is estimated to grow 5.9% on year in 2017.

- Global notebook shipment forecast, 2017 and beyond

This Digitimes Special Report examines key factors in the notebook industry, including products, vendors and ODMs, that will affect total shipments in 2017 and through 2021.

![[CES 2026] An Entertainment Companion for Every Moment Seen](https://loginby.com/itnews/wp-content/uploads/2026/01/1768923629_CES-2026-An-Entertainment-Companion-for-Every-Moment-Seen-100x75.jpg)