Fintech and proptech are two sectors which might be seeing exploding development in Latin America, as monetary companies and actual property are two classes specifically dire want of innovation in a area.

Brazil’s QuintoAndar, which has developed an actual property market centered on leases and gross sales, has seen spectacular development in recent times. And in the present day, the São Paulo-based proptech has introduced it has closed on $300 million in a Series E spherical of funding that values it at a powerful $Four billion.

The spherical is notable for just a few causes. For one, the valuation – excessive by any requirements however particularly for a LatAm firm – represents a rise of 4 occasions from when QuintoAndar raised a $250 million Series D in September 2019.

It’s additionally noteworthy who’s backing the corporate. Silicon Valley-based Ribbit Capital led its Series E financing, which additionally included participation from SoftBank’s LatAm-focused Innovation Fund, LTS, Maverik, Alta Park, an undisclosed US-based asset supervisor fund with over $2 trillion in AUM, Kaszek Ventures, Dragoneer and Accel associate Kevin Efrusy.

Having backed the likes of Coinbase, Robinhood and CreditKarma, Ribbit Capital has traditionally centered on early-stage investments within the fintech house. Its guess on QuintoAndar represents clear religion in what the corporate is constructing, in addition to its confidence within the startup’s plans to department out from its present mannequin right into a one-stop actual property store that additionally affords mortgage, title, insurance coverage and escrow companies.

The newest spherical brings QuintoAndar’s whole raised since its 2013 inception to $635 million.

Ribbit Capital Partner Nick Huber mentioned Quintoandar has over time constructed “a unique and trusted brand in Brazil” for these in search of a spot to name residence.

“Whether you are looking to buy or to rent, QuintoAndar can support customers through the entire transaction process: from browsing verified inventory to signing the final contracts,” Huber informed TechCrunch. “The ability to serve customers’ needs through each phase of life and to do so from start to finish is a unique capability, both in Brazil and around the world.”

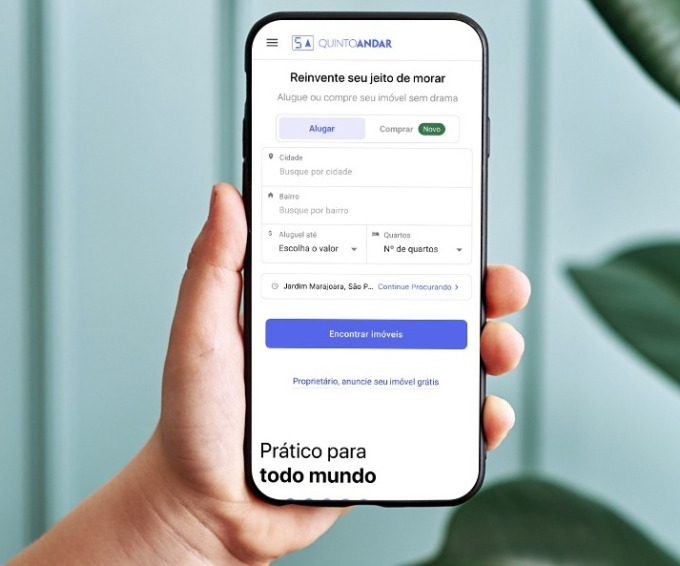

QuintoAndar describes itself as an “end-to-end solution for long-term rentals” that, amongst different issues, connects potential tenants to landlords and vice versa. Last yr, it expanded additionally into connecting a house patrons to sellers.

Image Credits: QuintoAndar

TechCrunch spoke with co-founder and CEO Gabriel Braga and he shared particulars across the development that has attracted such a bevy of high-profile buyers.

Like most different companies around the globe, QuintoAndar braced itself for the worst when the COVID-19 pandemic hit final yr – particularly contemplating one core piece of its enterprise is to ensure rents to the landlords on its platform.

“In the beginning, we were afraid of the implications of the crisis but we were able to honor our commitments,” Braga mentioned. “In retrospect, the pandemic was a big test for our business model and it has validated the strength and defensibility of our binsess on the credit side and reinforced our value proposition to tenants and landlords. So after the initial scary moments, we actually felt even more confident in the business that we are building.”

QuintoAndar describes itself as “a distant market leader” with greater than 100,000 leases underneath administration and about 10,000 new leases per thirty days. Its rental platform is stay in 40 cities throughout Brazil, whereas its homebuying market is stay in 4. Part of its plans with the brand new capital is to broaden into new markets inside Brazil, in addition to in Latin America as a complete.

The startup claims that, in lower than a yr, QuintoAndar managed to mixture the most important stock amongst digital transactional platforms. It now affords greater than 60,000 properties on the market throughout Sao Paulo, Rio de Janeiro, Belho Horizonte and Porto Alegre. To give larger context across the firm’s development of that facet of its platform: in its…