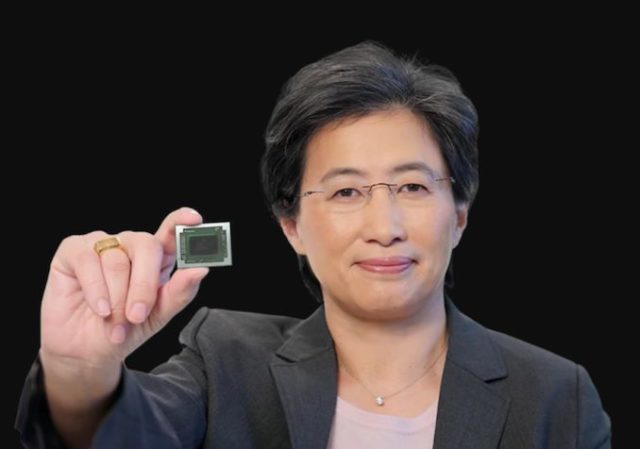

At the top of each monetary name, invited monetary analysts have a chance to probe the important thing members of the corporate on the numbers, in addition to future merchandise. We simply had AMD’s This autumn 2020 Financial name, overlaying all of This autumn developments in addition to 2020 as an entire. On the decision was CEO Dr. Lisa Su and CFO Davinder Kumar.

This is a transcription with further readability added.

Barclays: Your numbers showcase a strong annual steerage for 2021, with AMD stating that you simply anticipate to see all segments up in income. Can you give us any colour or element with regards section and product traces?

Lisa Su: So we’re excited as we transfer into 2021. 2020 was a fairly a powerful development yr for us. For our annual steerage, we anticipate to see energy throughout all of our companies. This will naturally be led by our giant segments: Server, PC, and Semi-custom/console. We can even see development in graphics throughout shopper graphics and datacenter graphics as we ramp out the complete product traces throughout 2021. Overall development in 2021 will come from the energy of our new product portfolio coupled with optimistic demand atmosphere.

Q: For the form of income in 2021, you said that will probably be higher than seasonal as we enter the yr. Can you speak about your ideas on the general PC market, in addition to how AMD’s yr will probably be formed by the semicustom enterprise in H1 in comparison with H2?

Lisa Su: You noticed a little bit of our expectations in what we stated with our Q1 steerage – Q1 can have higher than regular seasonality. In a standard yr we see sometimes see the primary half on a decline, under the second half which is usually shopper robust. From the form from market popping out of 2020, we see that the PC and gaming segments are performing higher than seasonally anticipated, and so they even have pent up demand. We are additionally seeing robust datacenter development, with server demand up sequentially in Q1. This is on the energy on our Rome product and the Milan product ramp. It implies that the 2021 yearly efficiency can have a distinct form in comparison with regular, however with robust demand throughout our three key segments: PC, datacenter and gaming.

Cowen: In the server numbers, we’re seeing an even bigger greenback contribution to development in comparison with prior years. Lisa talked about accelerated development for the datacenter in 2021, off of a enterprise that doubled final yr. Are there drivers of server development alongside merely launching Milan?

Lisa Su: We are pleased with our DC progress, and 2020 was a powerful yr. We anticipate to see a powerful development of our DC enterprise in 2021. Cloud enterprise is strengthening as we go into the primary half of the yr, each with present era Rome in addition to next-generation Milan. The reception to Milan from our prospects is powerful, with a superb efficiency profile. We began shipments of Milan to key cloud prospects in This autumn, and we are going to proceed in Q1 (full launch in March). We anticipate to see extra new prospects, and extra present prospects adopting our Milan platform. We can have a really robust enterprise portfolio, and robust time-to-market partnerships with key OEMs. That’s a part of our launch plan later in Q1. Overall we’re optimistic in DC, and we see a whole lot of want for compute within the cloud and for the enterprise market. In that occasion, Milan could be very properly positioned.

Q: It is not any secret that business is provide constrained, each as a result of market development in addition to the pandemic. Could you characterize the magnitude of provide constraints AMD is dealing with, and will they be hindering development? Most analysts thought that the large CAPEX enhance from TSMC might need been as a result of Intel ordering provide – however as you look by means of this yr, does the steerage for FY2021 incorporate rising provide and assumption of higher provide?

Lisa Su: As we take a look at the…

![[Interview] [Galaxy Unpacked 2026] Maggie Kang on Making](https://loginby.com/itnews/wp-content/uploads/2026/02/Interview-Galaxy-Unpacked-2026-Maggie-Kang-on-Making-100x75.jpg)