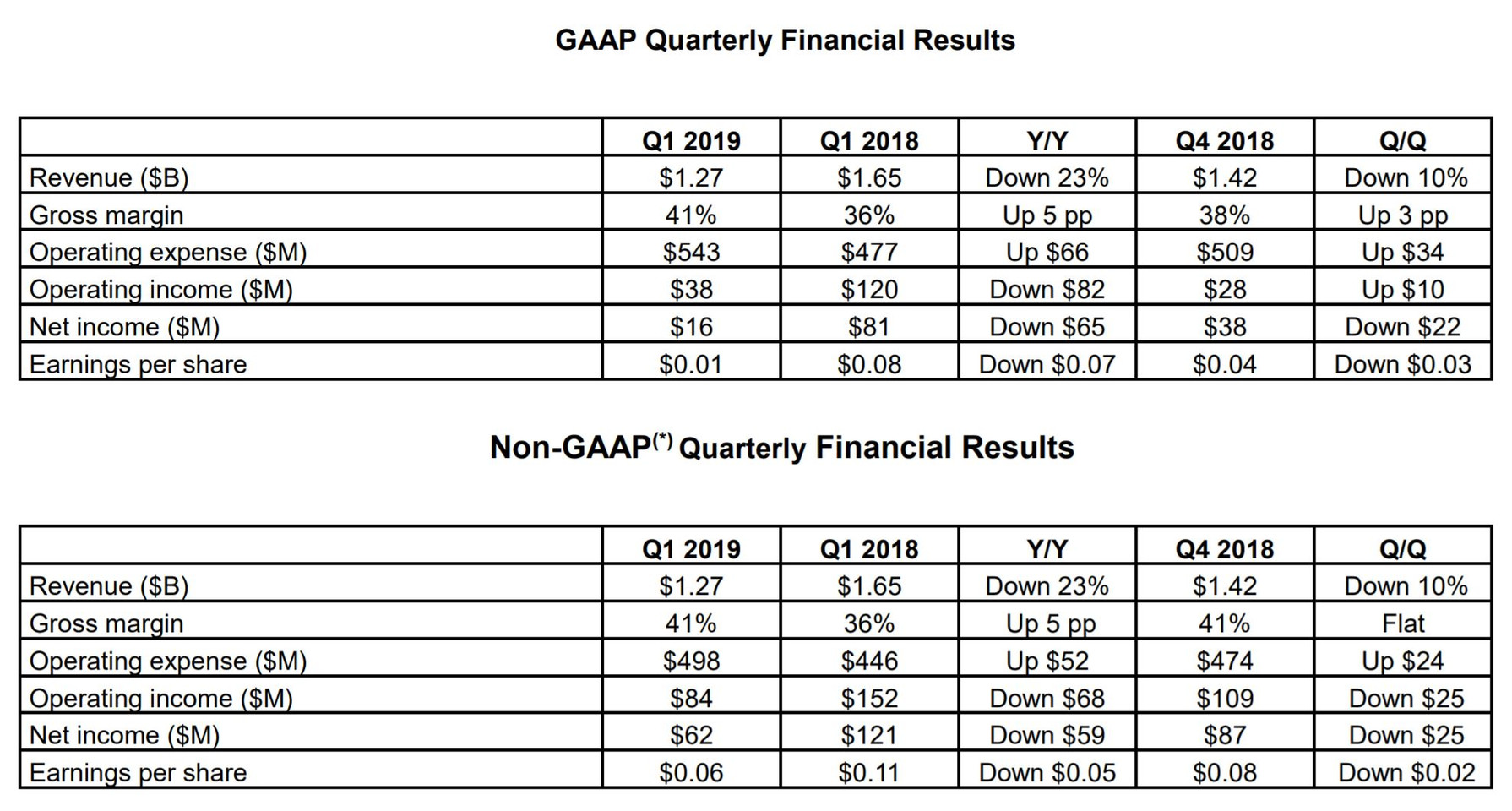

AMD at this time introduced income for the primary quarter of 2019 of $1.27 billion, working earnings of $38 million, internet earnings of $16 million and diluted

earnings per share of $0.01. On a non-GAAP

foundation, working earnings was $84 million, internet earnings was $62 million and diluted earnings per share was $0.06.

earnings per share of $0.01. On a non-GAAP

foundation, working earnings was $84 million, internet earnings was $62 million and diluted earnings per share was $0.06.

“We delivered solid first quarter results with significant gross margin expansion as Ryzen and EPYC processor and datacenter GPU revenue more than doubled year-over-year,” mentioned Dr. Lisa Su, AMD president and CEO. “We look ahead to the upcoming launches of our next-generation 7nm PC, gaming

and datacenter merchandise which we count on to drive additional market share beneficial properties and monetary progress.”

Q1 2019 Results

- Revenue was $1.27 billion, down 23 p.c year-over-year primarily as a consequence of decrease income within the Computing and Graphics phase. Revenue was down 10 p.c quarter-over-quarter primarily as a consequence of decrease shopper processor gross sales.

- Gross margin was 41 p.c, up 5 proportion factors year-over-year, primarily pushed by the ramp of Ryzen and EPYC processor and datacenter GPU gross sales. Gross margin was up three proportion factors quarter-over-quarter primarily as a consequence of a cost within the fourth quarter of 2018 associated to older expertise licenses. Non-GAAP gross margin was flat quarter-over-quarter.

- Operating earnings was $38 million in comparison with working earnings of $120 million a yr in the past and $28 million within the prior quarter. Non-GAAP working earnings was $84 million in comparison with working earnings of $152 million a yr in the past and $109 million within the prior quarter. The year-over-year decline was primarily as a consequence of decrease income and working earnings within the Computing and Graphics phase.

- Net earnings was $16 million in comparison with internet earnings of $81 million a yr in the past and $38 million within the prior quarter. Non-GAAP internet earnings was $62 million in comparison with internet earnings of $121 million a yr in the past and $87 million within the prior quarter.

- Diluted earnings per share was $0.01, in comparison with diluted earnings per share of $0.08 a yr in the past and $0.04 within the prior quarter. Non-GAAP diluted earnings per share was $0.06, in comparison with diluted earnings per share of $0.11 a yr in the past and $0.08 within the prior quarter.

- Cash, money equivalents and marketable securities had been $1.2 billion on the finish of the quarter.

Quarterly Financial Segment Summary

- Computing and Graphics phase income was $831 million, down 26 p.c year-over-year and 16 p.c quarter-over-quarter. Revenue was decrease year-over-year primarily as a consequence of decrease graphics channel gross sales, partially offset by elevated shopper processor and datacenter GPU gross sales. The quarter-over-quarter decline was primarily as a consequence of decrease shopper processor gross sales.

- Client processor common promoting value (ASP) was up year-over-year pushed by Ryzen processor gross sales. Client ASP was down barely quarter-over-quarter as a consequence of a lower in cellular processor ASP

- GPU ASP elevated year-over-year primarily pushed by datacenter GPU gross sales. GPU ASP was up sequentially pushed by improved product combine.

- Operating earnings was $16 million, in comparison with working earnings of $138 million a yr in the past and working earnings of $115 million within the prior quarter. The year-over-year and quarter-over-quarter working earnings decreases had been primarily as a consequence of decrease income.

- Enterprise, Embedded and Semi-Custom phase income was $441 million, down 17 p.c yearover-year and up 2 p.c sequentially. The year-over-year income lower was primarily as a consequence of decrease semi-custom product income, partially offset by greater server gross sales. The quarter-over-quarter improve was primarily pushed by greater semi-custom income.

- Operating earnings was $68 million, in comparison with working earnings of $14 million a yr in the past and an working lack of $6 million within the prior quarter. The year-over-year and sequential enhancements had been primarily pushed by a $60 million licensing acquire related to the corporate’s three way partnership with THATIC.

- All Other working loss was $46 million in contrast with working losses of $32 million a…