A brand new report highlights the demand for startups constructing open supply instruments and applied sciences for the snowballing AI revolution, with the adjoining information infrastructure vertical additionally heating up.

Runa Capital, the enterprise capital (VC) agency that upped sticks from Silicon Valley and moved its HQ to Luxembourg in 2022, has revealed the Runa Open Source Startup (ROSS) Index for the previous 4 years, shining a light-weight on the fastest-growing industrial open supply software program (COSS) startups. The firm publishes quarterly updates, nonetheless final 12 months it produced its first annual report taking a top-down view of the entire of 2022 — one thing it’s repeating now for 2023.

Trends

Data is intently aligned with AI as a result of AI depends on information for studying and making predictions, and this requires infrastructure to handle the gathering, storage, and processing of that information. And these tangential tendencies collided on this report.

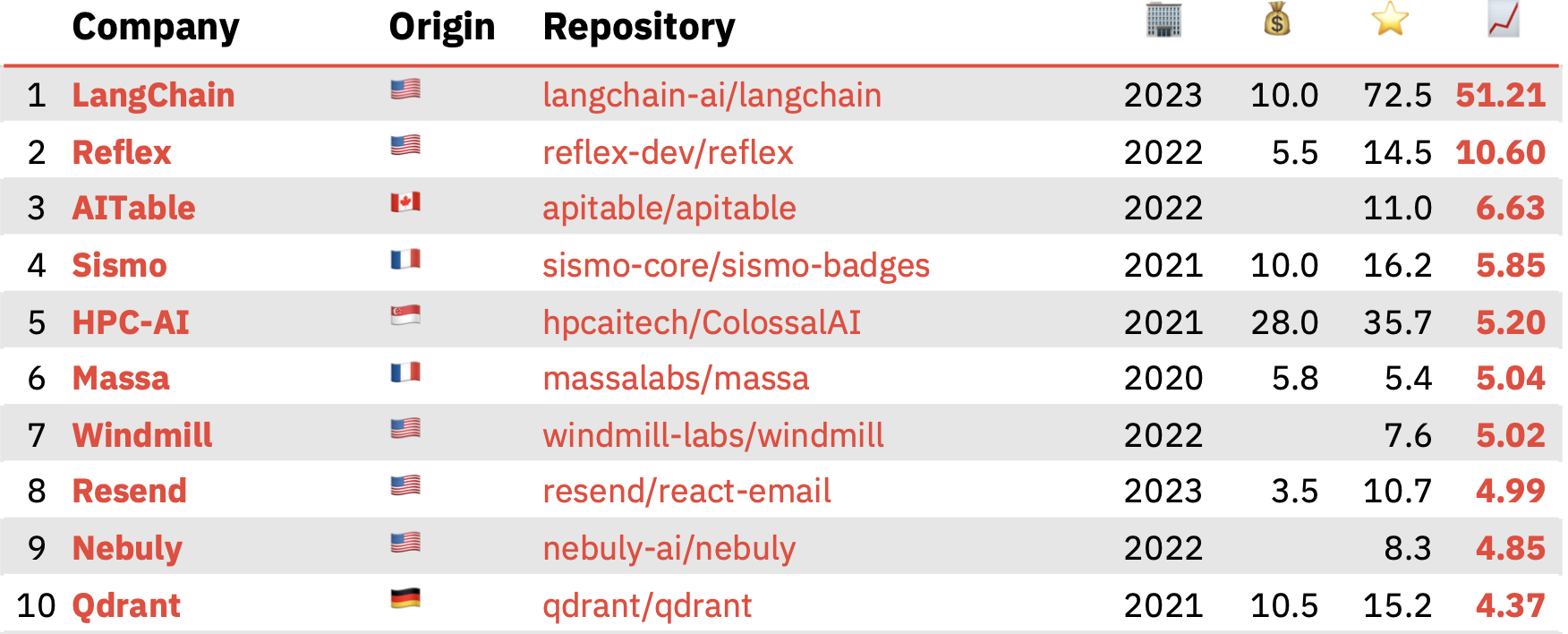

Hitting top-spot within the ROSS Index for final 12 months was LangChain, a two-year-old San Francisco-based startup that has developed an open supply framework for constructing apps primarily based on giant language fashions (LLMs). The firm’s principal undertaking handed 72,500 stars in 2023, with Sequoia occurring to steer a $25 million Series A spherical into LangChain simply final month.

Top 10 COSS startups within the ROSS Index for 2023 Image Credits: Runa Capital

Elsewhere within the prime 10 is Reflex, an open supply framework for creating net apps in pure Python, with the corporate behind the product lately securing a $5 million seed funding; AITable, a spreadsheet-based AI chatbot builder and one thing akin to an open supply Airtable competitor; Sismo, a privacy-focused platform that enables customers to selectively disclose private information to functions; HPC-AI, which is constructing a distributed AI improvement and deployment platform in a push to turn out to be one thing just like the OpenAI of Southeast Asia; and open supply vector database Qdrant, which lately secured $28 million to capitalize on the burgeoning AI revolution.

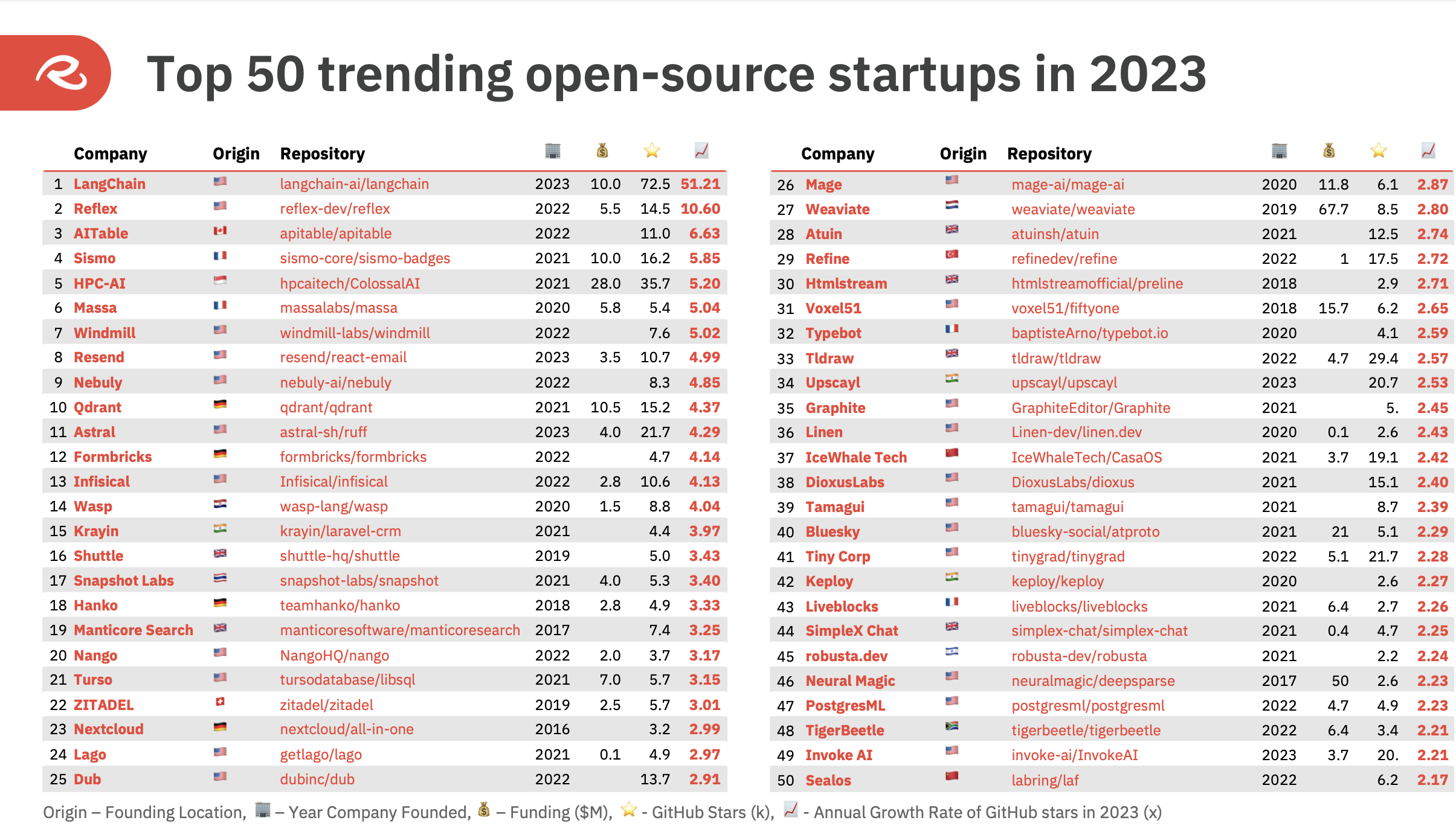

A broader have a look at the “top 50 trending” open supply startups final 12 months reveals that greater than half (26) are associated to AI and information infrastructure.

Top 50 COSS startups within the ROSS Index for 2023 Image Credits: Runa Capital

It’s troublesome to correctly examine the 2023 index with the earlier 12 months from a vertical perspective, due largely to the truth that companies typically pivot or change their product-positioning to swimsuit what’s scorching immediately. With the ChatGPT hype prepare going full throttle final 12 months, this will likely have led earlier-stage startups to change their focus, and even simply place higher emphasis on the prevailing “AI” factor of their product.

But as generative AI’s breakthrough 12 months, it’s straightforward to see why demand for open-source componentry would possibly skyrocket, as corporations of all sizes look to maintain apace with proprietary AI juggernauts comparable to OpenAI, Microsoft, and Google.

Geographies

Open supply software program has additionally all the time been very distributed, with builders from all around the world contributing. This ethos typically interprets into industrial open supply startups which could not have a conventional heart of gravity anchored by a brick-and-mortar HQ.

However, the ROSS Index goes a way towards bringing geography into the image, reporting that 26 corporations on the checklist have an HQ within the U.S., although 10 of those corporations originated elsewhere and nonetheless have founders or workers primarily based in different locales.

In whole, the highest 50 hailed from 17 separate international locations, with 23 of the businesses integrated in Europe — a 20% rise on the earlier 12 months’s index. France counted probably the most COSS startups with seven, together with Sismo and Massa that are within the prime 10, whereas the U.Ok. soared from only one startup in 2022 to 6 in 2023, putting it in second place from a European perspective.

Other notable tidbits to emerge from the report embrace programming languages — the ROSS Index recorded 12 languages utilized by the highest 50 final 12 months, versus 10 in 2022. But