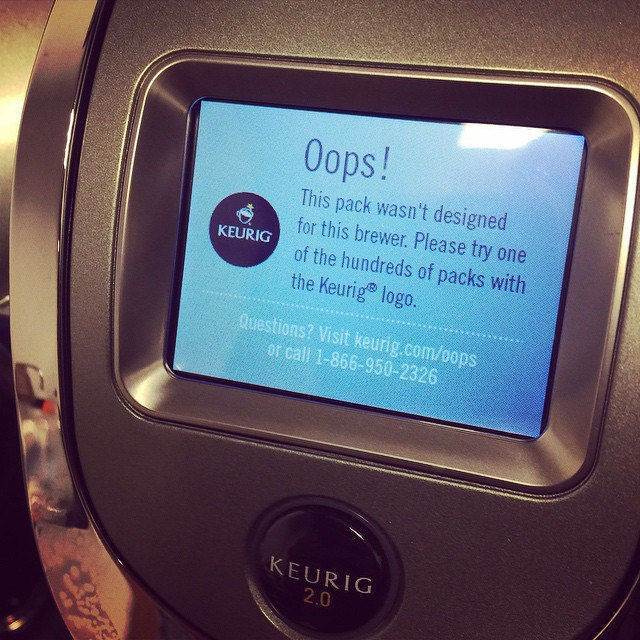

This message may have driven many Keurig users to vote with their dollars. But now Keurig is getting an infusion of private money. (credit: Ryan Lane)

In the finance world today, everyone is abuzz with the news of a giant buyout—JAB Holding company, which manages the money of one of Germany’s wealthiest families, agreed to buy struggling coffee maker Keurig Green Mountain for $ 13.9 billion, valuing the company at $ 92 a share, compared with the $ 51.70 a share that the company was trading at last Friday afternoon.

When first we heard of Keurig Green Mountain’s Keurig 2.0 coffee maker, news was that the appliance would brew only pods approved by Keurig specifically—no third-party pods allowed.

When the Keruig 2.0 came out, that was exactly the case. The scheme was akin to what we’ve seen from some content distributors in Digital Rights Management (DRM), which makes it harder to, say, move a Kindle book to a non-Kindle tablet. In Keurig’s case, approved pods had special ink markers printed on their lids, and the Keruig 2.0 had a scanner looking for said special marker. If the marker wasn’t there, the Keurig displayed an “Oops!” message and would not continue to brew the coffee.

Read 7 remaining paragraphs | Comments

![]()

![[MWC 2026] A Sound Immersion Experience With Galaxy Brings](https://loginby.com/itnews/wp-content/uploads/2026/03/1772736146_MWC-2026-A-Sound-Immersion-Experience-With-Galaxy-Brings-100x75.jpg)